The benchmark interest rate in Singapore was last recorded at 0.46 pct.

While the Fed looks through the rise in prices, the real exchange rate would appreciate. A week that delivered hawkish Fed testimony and a solid set of upside data surprises failed to deliver a stronger dollar. This inability to sustain a rally despite a perfect overlap of hawkish fed and bullish data this week, suggests we might need something more phenomenal for the USD to materially retrace back to January highs, much less a break of new highs.

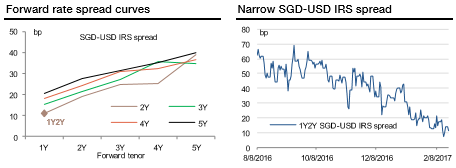

A bearish FX scenario is figured out in asymmetric risk as SGD rates have outperformed USD rates for an extended period (since February 2016), first characterized by easing in SGD rates which was followed by resilience in SGD rates amid rapid increases in USD rates.

We believe SGD-USD IRS spreads will widen from here, and encourage interest rate swaps to mitigate the resilience between currencies and rates.

First, we remain bearish towards SGD, while implied rates are not reflecting it at all being more impacted by the liquidity situation. The risk is to the upside for implied SGD rates should the FX view becomes more influential.

Second, the MAS is likely to keep policy unchanged in April, but in the small chance that they do something it will be in the direction of easing rather than tightening, on economic weakness.

Third, a much more constructive EM sentiment is needed to further push SGD rates lower vis-à-vis USD rates. The phenomenon of SGD rates persistently lower than USD rates in 2014 is unlikely to repeat.

Fourth, FX swap flows for USD funding needs should mainly impact the short end (below 1Y tenor).

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Morgan Stanley Raises KOSPI Target to 5,200 on Strong Earnings and Reform Momentum

Morgan Stanley Raises KOSPI Target to 5,200 on Strong Earnings and Reform Momentum  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate