EURAUD uptrend has been edgy and kind of stuck in a range, the swings are oscillating between 1.6191 and 1.5620 levels with some sort of bearish indications.

We stated this in our recent post under the title of “Can it be EURAUD’s head and shoulder as upswings restrained below 21-DMA and gravestone doji pops up to signal weakness?”

While the trade minister, Steve Ciobo, has called for Australia has a permanent exemption from the US steel tariffs because of its trade deficit.

The tariff rattling in the trade war continues. China’s announcement to impose tariffs on US goods amounting to USD 50bn caused notable insecurity on the FX market. Initially, analysts had expected that China’s countermeasures would not fully match the US tariffs on Chinese products.

In order to take advantage of vol/correlation setup, one could play directionally stronger reserve currency vs. weaker high beta (vs. the USD) via worst-of options. Rich correlations and still generally depressed vols (especially in EUR crosses) map into the favorable pricing of worst-of options for EURUSD vs. AUDUSD that are priced near the multi-year lows in premium (refer above chart).

Moreover, even absent trade skirmishes, the anticipated direction of the two currencies is in line with our analysts’ view of EUR outperformance this year as ECB moves towards policy normalization and antipodean central banks staying on hold in the face of structural headwinds.

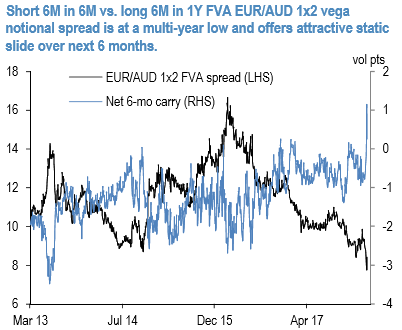

Long vega hedge via cheap FVA spreads: 1x2 forward volatility (FVA) spreads utilize favorable vol slide along term structures and are passage-of-time friendly, low maintenance long vega positions.

The basic construct involves selling a shorter dated FVA along the upward sloping segment of the vol curve to partially fund the purchase of a longer dated FVA along a flatter part of the term structure.

The roll-down of the short leg compensates (or even eliminates) the slide of the long position while preserving the overall net long vol exposure of the structure.

Historically P/L on this type of structures closely coincided with bounces in the spread pricing (refer above chart).

In the case of EUR/Antipodean crosses, current entry levels near pre-GFC lows are a bargain by historical standards (refer above chart), while the net 6 months static vol slide at forward start of the short leg is substantially positive (+1vol), making the long/short structure superior to holding a similar expiry straddle. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation