USDCNY has risen to a new high and is trading close to the psychologically crucial 7 level. USDCNY levels above 7 would, in our opinion, be associated with significant risks to China's outlook and financial stability. This morning, the PBoC's clear commitment to the stability of the renminbi was able to halt the upward movement for the time being. But in the longer term there is still no sign of a relaxation. The focus is on the Trump Xi meeting next month.

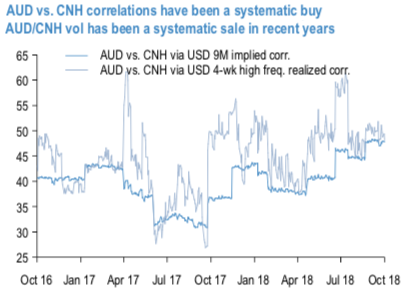

Owning USD-vol vs. selling cross-vol is usually a winning RV stance, especially in the kind of dollar- centric, risk-negative market environment that prevails currently. Option markets are typically quick to price in this dollar-centricity by lifting USD-implied correlations; in the case of AUD vs. CNH however, the rise in implied corrs. has trailed the consistently high realized corrs over the past couple of years (refer above chart), meaning there is still value to be realized from selling the AUDCNH cross vol against owning either/both of the USD-vols of the triangle (AUDUSD and/or USDCNH).

Given the economic linkages between Australia and China, it is not unreasonable to expect this correlation to remain elevated, and possibly climb further if the RMB weakness picks up steam.

The spot market impact of high AUD vs. CNH realized correlation is that AUDCNH the cross behaves as a bounded asset for the most part despite trends in the two USD pairs, which makes it a good candidate for selling strangles in. The AUDCNH strikes chosen above are conservative and span 80% of the history of spot over the past 4-years.

Hence, a zero-cost option implementation is proposed for owning USDCNH upside by buying USD calls/CNH puts financed by selling AUDCNH strangles (live, no delta-hedging): Off spot refs. 6.9365 (USDCNH) and 4.9335 (AUDCNH), buy 9M 7.12 strike (40-delta) USD calls/CNH puts vs. sell 9M 4.60 – 5.20 AUDCNH strangle, equal CNH notionals/leg for zero-cost. The USDCNH call costs 165bp standalone (mid). Courtesy: JPM

Currency Strength Index: FxWirePro's hourly CNY spot index is inching towards -119 levels (which is bearish), hourly USD spot index was at 114 (bullish) while articulating (at 10:40 GMT). For more details on the index, please refer below weblink:

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed