We would say GBPCAD likely to evidence some corrections but if you think that GBP should revert to outperformance on the crosses or you are in love with GBPCAD's uptrend or stuck with any payable exposure, now worries we have a customized hedging arrangement, while 1M ATM volatilities remain higher at 12.08%, then cover your underlying currency exposures with collars strategy exclusively on hedging grounds.

Further into 2016, there are two key risks for GBP - the UK's unsustainable current account deficit and the EU referendum, promised for end-2017 at the latest. Not only that, so long as the government's strategy to reduce the budget deficit remains credible, the deficits (internal and external) should remain fundable, but it is increasingly the case that rate hikes are required to stop downside risks to GBP crystalizing. As to the rising risk of UK EU exit, on the face of it, there are reasons to think GBP should carry a rising risk premium.

Technical glimpse: Currently, the pair is struggling at 1.9950 with more selling pressures boiling, in our opinion it seems unlikely to hold this level even during US sessions then there would certainly be a steep dips on daily charts which is to be treated as more booster for continuation of downtrend with leading oscillators are showing downward convergence with the price dips. RSI (14) on intraday terms approached oversold zones and still converging with every price declines, while prevailing prices have slid below 21DMA that signifies downtrend to prolong in the days to come.

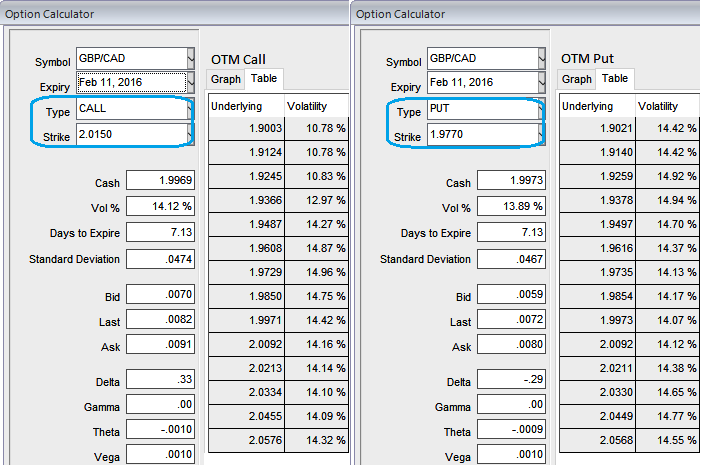

Hedging Strategy: The strategy is constructed for those who have spot FX Euro exposure at present who are concerned about a correction and wish to hedge the long spot currency position, Write deep (1%) OTM call option + hold an (-1%) OTM put option (near month Call & mid-month put). This helps as a means to hedge a long position in the underlying outrights by holding longs on protective put.

The gamma of the collar spreads is the summation of position adjusted gammas of its component option instruments. Gamma of both OTM call strike (2.0150) and OTM put strike (1.9770) have been zero. So, Gamma of collar spread which would again be closer zero. Gamma of the option is mainly dependent on the moneyness of the option. Well, when you are shorting OTM call with positive theta this is a good news for writers.

Thereby, the maximum return = Strike price of call - Currency spot price - net premium paid or Strike price of call - Currency spot price + net credit received on short side. Remember again, this is purely for hedging; speculators should stay away from this strategy.

FxWirePro: Adamant bulls in GBP/CAD can hedge unsustainable rallies with collar gamma combinations

Thursday, February 4, 2016 12:09 PM UTC

Editor's Picks

- Market Data

Most Popular