Contemplating the recent fundamental, technical and OTC developments, we’ve devised options strategy for EURCAD on hedging grounds.

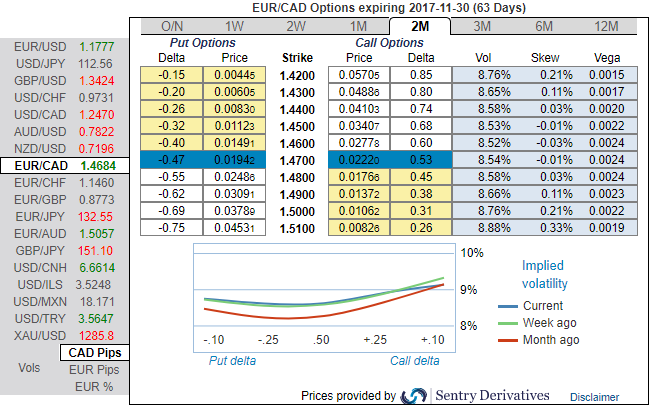

Mechanics: Buy EURCAD 2m ladder, strikes 1.4080/1.4678/1.4988 (we wouldn’t like to be precise about the indicative offer, certainly assured but slightly lower than vanilla structure, spot ref: 1.4678).

Rationale: We’ve already stated that there has been stiff tug of war between EURCAD bulls and bear in the recent past.

Technically, EURCAD has been drifting in the range between 1.4988 -1.4457 from last 3-4 months. We foresee the trend is likely to hover in the similar range but certainly not any dramatic spikes nor slumps.

Large options set to constrict today’s range.

Fundamentally, Canadian growth considerably breaks out, convincingly decoupling and outperforming the US. The most recent 4.5% QoQ, SAAR 2Q GDP growth print is highest quarterly sequential growth rate since 3Q’11, and reflects a genuine sustained acceleration in growth, with the prior three quarters averaging a 3.5% pace of growth, following six quarters averaging 0.5% annualized growth in the period following the collapse of oil price.

The EURCAD appreciation is now going to be slower than it has recently been, and the skew is still undecided whether volatility should rise on the back of a higher or lower spot (refer above nutshell evidencing IV skews). As such, we do not focus on intermediary vega gains to favour instead a buy-and-hold structure benefiting from the passage of time, as the timing of euro upside is less certain.

Risks profile: See unlimited risk above 1.4988, the above structure exposes investors to unlimited risks if the EURCAD trades above 1.4988 at the 2m expiry, a level not seen since last month.

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One