Chart - Courtesy Trading View

AUD/USD slipped lower from session highs at 0.6642 and was trading largely unchanged on the day at 0.6619 at around 03:10 GMT.

Aussie whipsawed on Thursday as fears for the global banking system sent investors fleeing from riskier assets.

Australia jobs number exceeded expectations, with Employment Change at 64.6K vs. 48.5K expected, compared to a prior -11.5K.

The Unemployment rate also edged lower to 3.5% from the previous 3.7%. Full-time employment saw a significant surge to 74.9K from the previous -43.3K.

Upbeat result adds to the case for the Reserve Bank of Australia (RBA) to hike interest rates again at its next meeting in April.

That said, Credit Suisse turmoil eclipsed upbeat Australian data. Markets spooked when Swiss regulators were forced to pledge liquidity support to the ailing Credit Suisse bank.

Safe haven currencies like the U.S. dollar and the yen were in bid on Thursday on renewed fears of a global banking crisis.

Technical Analysis:

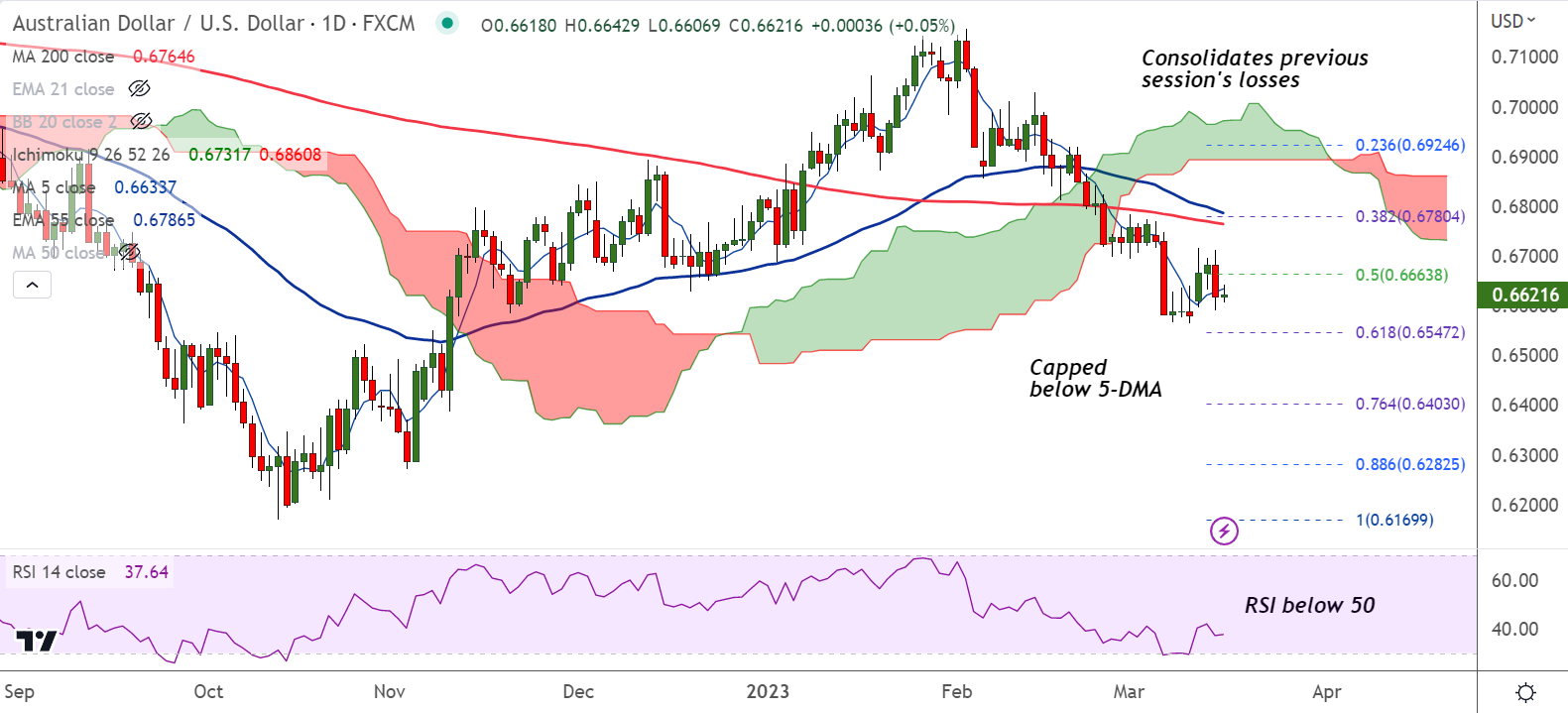

- AUD/USD trades below cloud and major moving averages

- GMMA indicator shows major and minor trend in the pair are bearish

- MACD and ADX support further weakness in the pair

- Momentum is bearish and volatility is high and rising

Major Support Levels: 0.6547 (61.8% Fib), 0.6521 (lower BB)

Major Resistance Levels: 0.6632 (5-DMA), 0.6716 (21-EMA)

Summary: AUD/USD struggles to make headway as markets remain jittery and await further clarity on how widespread the fallout could be. Focus now on how central banks will navigate their paths on future rate hikes.

Technical bias for the pair is bearish. Upside lacks traction. Scope for test of 61.8% Fib at 0.6547. Bearish invalidation only above 200-DMA.