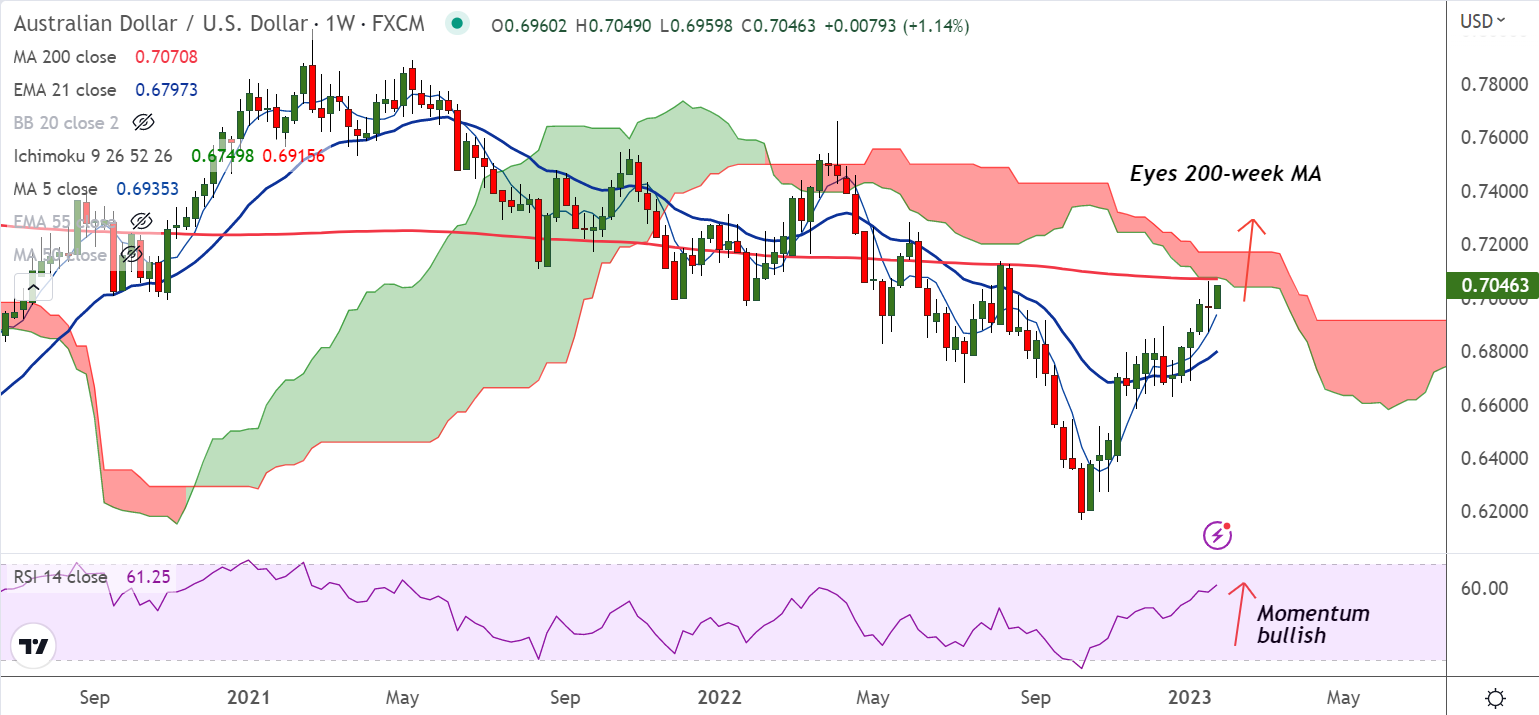

Chart - Courtesy Trading View

Spot Analysis:

AUD/USD was trading 0.33% higher on the day at 0.7047 at around 07:00 GMT

Previous Week's High/ Low: 0.7063/ 0.6871

Previous Session's High/ Low: 0.7039/ 0.6959

Fundamental Overview:

The release of downbeat preliminary Australian S&P PMI data seems to have little impact on Aussie bulls.

Data released earlier on Tuesday showed Australian Manufacturing PMI fell consecutively for the seven-month to 49.8 missing expectations for an expansion to 50.3.

Also, the Services PMI has dropped to 48.3, missing the consensus of 49.7.

The Reserve Bank of Australia is expected to continue its restrictive monetary policy despite a contraction in economic activities.

Focus going forward will be on the release of the Australian Consumer Price Index (CPI) data for the fourth quarter of CY2022 on Wednesday.

The annual CPI is expected to rise further to 7.5% from the prior release of 7.3%. While monthly inflation is seen sharply higher at 7.7% from the prior release of 7.3%.

On the other side, data shows that US inflation is softening further, accelerating the odds of 25 basis points (bps) interest rate hike by the Fed in its February policy meeting.

Technical Analysis:

- AUD/USD is testing 110-week EMA resistance at 0.7035

- GMMA indicator shows major and minor trend are bullish

- Momentum is bullish and volatility is high and rising

- Price action is well above cloud and Chikou span is biased higher

Major Support and Resistance Levels:

Support - 0.6976 (5-DMA), Resistance - 0.7070 (200-week MA)

Summary: AUD/USD trades with a bullish bias. The pair is poised to test 200-week MA at 0.7070.