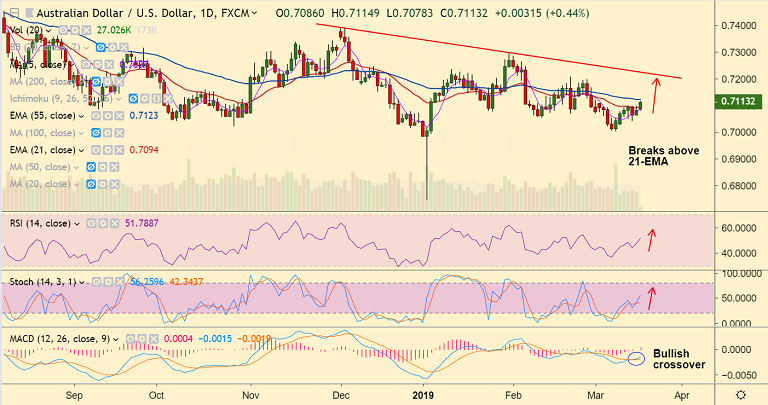

AUD/USD chart - Trading View

- AUD/USD has broken above 0.71 handle and is currently trading near session highs at 0.7113.

- The Aussie is supported by uptick in iron ore prices. Dalian iron ore futures are nearly up 2 percent.

- Also, broad-based US dollar weakness, triggered by the dip in treasury yields, aids upside in the pair.

- Technical indicators on daily charts have turned bullish. Scope for test of 55-EMA at 0.7123.

- Stochs and RSI are biased higher and MACD is on verge of bullish crossover on signal line.

- Price action has broken above 21-EMA and break above 55-EMA will see test of 110-EMA.

- Weakness only on retrace below 21-EMA. Dip till 0.70 handle then likely.

Support levels - 0.7094 (21-EMA), 0.7069 (cloud base), 0.70

Resistance levels - 0.7123 (nearly converged 4H 200-SMA and 55-EMA), 0.7166 (110-EMA), 0.7225 (trendline)

Recommendation: Good to go long on dips around 0.7110, SL: 0.7075, TP: 0.7125/ 0.7165/ 0.72

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.