Although Aussie dollar has potential to break above 0.6762 levels, supported by improving global sentiment. but in coming weeks the reality of a tepid global recovery in H2’20 and woeful earnings reports are likely to chip away at risk sentiment. Scope for 0.62 end-June.

RBA is scheduled for their monetary policy this week, the medium-term perspectives for AU swap yields are explained here: The combination of the RBA's liquidity injections, asset purchases and Term Funding Facility has dampened volatility out to 3 years, where 3yr swap rates are expected to remain around the 0.25% level. 10yr swap rates will exhibit greater volatility, however we expect them to trade a relatively narrow range centred on 1.00%.

Bearish AUDUSD Scenarios below 0.63 levels if:

1) China-Australia trade tensions continue to escalate;

2) USD surges on the unwind of USD funded non-financial liabilities;

3) The equity vol surges again as risk markets correct lower.

Bullish AUDUSD Scenarios above 0.66 levels if:

1) Bulk commodity prices remain elevated and Chinese growth numbers validate the v-shape recovery;

2) The US political developments ahead of the November election weaken the USD; or

3) Markets start to worry about the US CAD and budget deficit in an era of near zero rates.

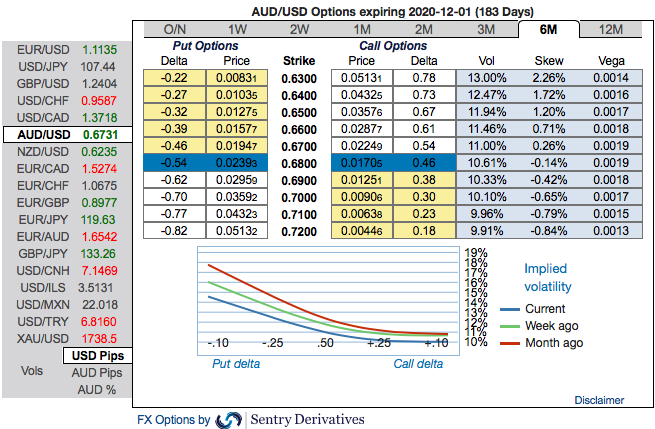

OTC outlook: The positively skewed IVs of 6m tenors are in line with the bearish expectations, they still signify the hedgers’ interests to bid OTM put strikes up to 0.63 levels (refer 1st chart).

While we see fresh positive bids for the existing bearish risk reversal (RRs) setup across all the longer tenors (refer 2nd chart).

In a nutshell, AUD OTC hedgers’ sentiments substantiate that their risk mitigating activities for the further downside potential has been clear amid interim upswing expectations.

Quick run through on options strategy:

Considering all the above factors, we could foresee the rosy times for the OTM overpriced put writing, accordingly, diagonal debit put spreads have been advocated so as to mitigate the potential downside risks with a reduced cost of trading.

The combination of AUDUSD’s short-term higher potential amid lower IVs was luring the OTM put options writing. While the medium-term perspective is attractive for bearish hedges via ITM puts.

The options strategy reads this way: short 2w (1%) OTM put option with positive theta (position functioned as per the expectations as the underlying spot has rallied considerably), simultaneously, add long in 2 lots of delta long in 3m (1%) ITM -0.79 delta put options. We keep reiterating that the deep in the money put option with a very strong delta will move in tandem with the underlying spot FX. Courtesy: Sentry, JPM & Saxo

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch