AUDUSD medium term perspectives: It is worthwhile to watch the key 0.8000 level breach for the day – will it attempt another break above, as it did last night? AU GDP will be key today, as will be USD direction.

As the RBA remains firmly on hold, as widely expected, and the US dollar rises on tighter Fed policy, then AUDUSD could fall to 0.76 by year end.

OTC outlook and Options Strategy:

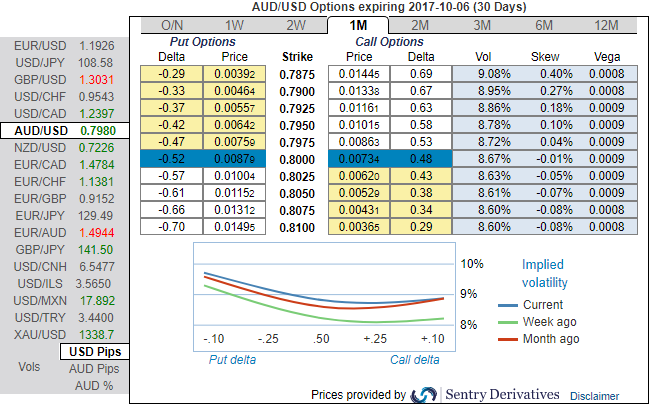

Please be noted that the positively skewed IVs of 1m tenors signify the hedgers’ interests to bid OTM put strikes upto 0.7875 levels (refer above diagram).

While bearish neutral delta risk reversal divulges the interests in hedging activities for downside risks remains intact amid mild upswings.

Well, the bearish stance has been substantiated by AUDUSD's rising IV in 1-3m which is an opportunity for put longs in long term and using shrinking IVs of shorter tenors with bearish neutral delta risk reversal can be interpreted as an opportunity for writing OTM puts or Theta shorts in short run as the spot FX market reckons the price has downside potential for large movement in the days to come which is resulting option holders’ on competitive advantage.

Accordingly, we had advocated put ratio back spreads a couple of days ago, wherein short leg is functioning as the underlying spot FX keeps spiking.

So, the speculators and hedgers for bearish risks are advised to capitalize on the prevailing rallies and bid on 1-3m risks reversals to optimally utilize Vega longs.

We advocate weighing up above aspects and uphold the same option strategy on hedging grounds, we eye on loading up with fresh Vega longs for long term hedging, more number of longs comprising of ATM instruments and ITM shorts in short term would optimize the strategy.

So, the execution of hedging positions goes this way:

Short 2w (1%) OTM put option as the underlying spot likely to go either sideways or spike mildly, simultaneously, go long in 2 lots of vega long in 2m ATM -0.49 delta put options.

A move towards the ATM territory increases the Vega, Gamma, and Delta which boosts premium. However, Theta (time decay) also increases especially as expiry approaches. Hence, OTM shorts in calls in such scenario are most suitable for speculation.

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary