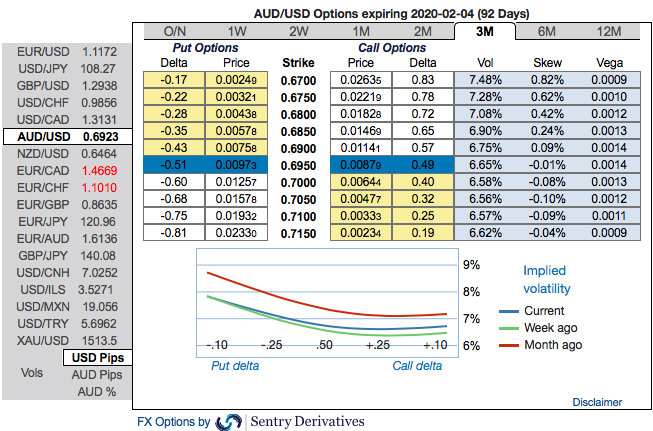

Ahead of RBA’s monetary policy scheduled for this week, the OTC outlook of AUDUSD are useful for the options strategic framework.

Please be noted that the positively skewed IVs of 3m tenors still signify the hedgers’ interests to bid OTM put strikes up to 0.67 levels which is still in line with the above bearish projections (refer 1st nutshell).

Please also be noted that bearish risk reversals (RRs) across all the longer tenors are also in sync with the bearish scenarios amid momentary shift in mild upside risks (refer 2nd (RR) nutshell).

In a nutshell, AUD OTC hedgers’ sentiments substantiate that their risk mitigating activities for the downside risks has been clear.

The combination of AUDUSD’s short-term potential to break above 0.6930 and lower IVs is luring for the OTM put options writers. While the medium-term perspective is attractive for bearish hedges via ITM puts.

The rationale: The Aussie has closed within a 0.6700-0.6900 range every day since late July. The mid-October bounce has been aided by a more positive tone on US-China trade talks but probably won’t be more durable than the early September rally. Iron ore prices are rolling over on patchy demand and resilient supply, while we believe the US and China still have major hurdles which will keep tariffs in place. Limiting downside though, we expect the RBA to hold steady into 2020 as it remains hopeful on Australia’s growth outlook and spec short A$ positioning is substantial. Any near-term probes above 0.6900 should attract sellers, with our year-end target still 0.6700 which is sync with the IV skews.

Accordingly, diagonal put spreads are advocated to mitigate the downside risks with a reduced cost of trading.

The execution of options strategy: Short 2w (1%) OTM put option with positive theta (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, add long in 2 lots of delta long in 3m (1%) ITM -0.79 delta put options.

The rationale: Bidding above 3m IV skews, we have advocated delta long puts for the long term on hedging grounds, comprising of more number of ITM long instruments and theta shorts with narrowed tenors for 1m lower IVs to optimize the strategy.

Bearish outlook with rising volatility good for the option holder.

While put writers would be on upper hand on theta shorts in OTM put options that would go worthless on lower IVs as the underlying spot FX keeps rising,. Thereby, the premiums received from this leg would be sure profit.

We keep reiterating that the deep in the money put option with a very strong delta will move in tandem with the underlying.

Alternatively, on hedging grounds ahead of RBA’s monetary policy that is scheduled for this week, we advocate shorting futures contracts of mid-month tenors as the underlying spot FX likely to target southwards below 0.66 levels in the medium run. Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position. Courtesy: Sentrix, Westpac and Saxobank

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures