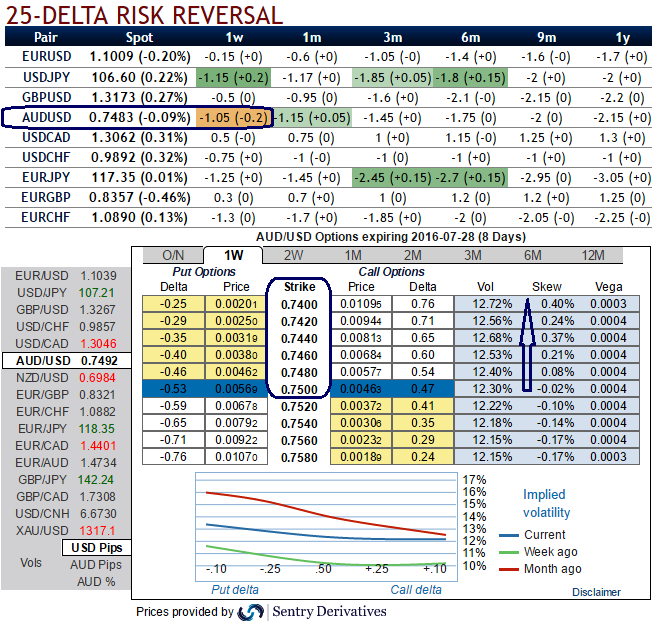

The foreign traders dealing with AUDUSD ahead of RBA cash rates in early August make bearish sentiments in 1W OTC contracts – negative risk reversal still signals bearish bias.

AUD/USD currently perceives the implied vols above 12.5% for 1w expiries and skewness flashes with positive numbers that signifiy the OTM strikes interests.

Volatility smiles most frequently show that traders are willing to pay higher implied volatility prices as the strike price grows aggressively out of the money.

Well, these OTM strikes have healthy vega numbers as well which means the contracts with these strikes are likely to get benefitted from the IV factor along with bearish underlying movements.

Risk reversal numbers in both short and long term signals downside risks, extreme negativity has been built-up about next 12 months tenors.

However, any abrupt upswings could be viewed as a better entry point to stay short in this pair and long term range lows have led to the deeper southward targets which still appears incomplete ahead of RBA’s rate cut expectations.

While maintaining an impulsive bearish trend bias, the near-term focus is to hedge such downside risks using IV advantage.

Traders tend to view the put ratio back spread as a bear strategy, because it employs puts. However, it is actually a volatility strategy.

So entering the position when implied volatility is high and waiting for the inevitable adjustment is a smart approach, regardless of the direction of price movement. Based on volatility and time decay, the strategy is a “price neutral” approach to options and one that makes a lot of sense.

Since AUDUSD is still stuck in its 0.7000/0.7650 range despite showing little strength, mirroring the lack of direction in front-end AU-US rate spreads.

We reckon the back spread using narrow expiries could mitigate near-term downside risks in this pair, so here goes the strategy, bidding 1w risk reversals initiate longs in 2 lots ATM puts while writing 2D ITM put (with 1% strikes).

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts