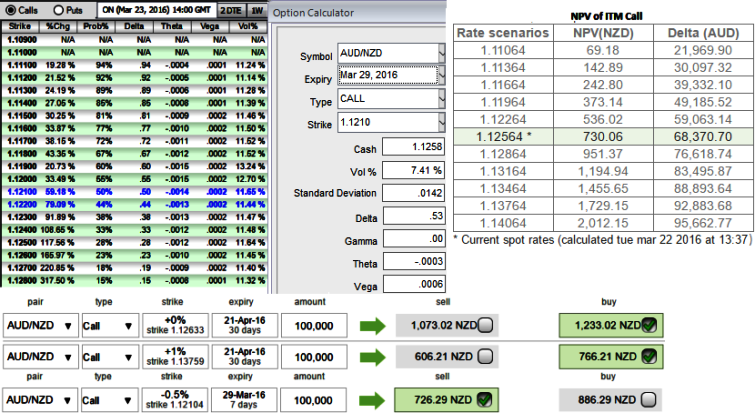

ATM IVs of 1W expiries are at 7.41%, and 8.59% for 1M tenor.

Although the momentum in long term bull trend is reduced, but from last couple of weeks regained the strength, Aussie dollar against Kiwi dollar has been gaining considerably (about 6.50% while articulating) as both all technical indicators are still signalling buying sentiments.

But if you have to evaluate the ATM IVs with the monthly technical chart, the prevailing bullish swings may not be having the same momentum in rallies as we are seeing it right now.

Technically, we see a stiff resistance at 1.1290 and 1.1416 levels.

If IV is high, it means the market thinks the price has potential for large movement in either direction. Low IV implies the market thinks the price will not move much and so that it is beneficial for option writers.

As shown in the diagram, ITM calls (0.5%strikes) are trading 21.36% more than NPV, a huge disparity between IVs and option premiums.

Since the current rallies can see stiff resistance at 1.1290 we could foresee in short term it can very well be interpreted as short bulls may struggle but in long term the resultant effects of RBNZ's surprising rate cut by 25bps in its monetary policy and further scope of easing may prop up the pair to the higher levels.

So, trading option spreads in different strikes allows the traders in many tricky market scenarios and likely to fetch positive cashflows.

Hence, we recommend initiating longs in 1M ATM +0.51 delta call, 1 lot of (1%) OTM +0.36 delta call and simultaneously short 1 lot of deep OTM call (2%) with comparatively shorter expiry in the ratio of 2:1.

The lower strike short calls seems little risky but because IV is reducing, the likelihood of options expiring in the money is very less and it finances the purchase of the greater number of long calls (ATM calls are overpriced, so we chose 1% OTM calls as well) and the position is entered for reduced cost.

Delta measures the shift in option's premium with corresponding shift in the currency pair exchange rate. Another way to think of Delta is as if it's your outright spot exposure.

A seller wants IV to fall so the premium falls. You should also note short-dated options are less sensitive to IVs, so in this strategy we have short position suitable to both above conditions.

At spot ref: 1.1240, if AUDNZD remains sideways but slightly slides below 40-50 pips on expiration then the premiums on shorts are assured returns and reduces hedging cost. Thereafter the pair to bouncing back above 1.1240 hedges upside risks.