If you have to compare the 1W ATM IVs with monthly tenors, then the prevailing bullish swings may not be having the same momentum in rallies going forward as we are seeing it right now.

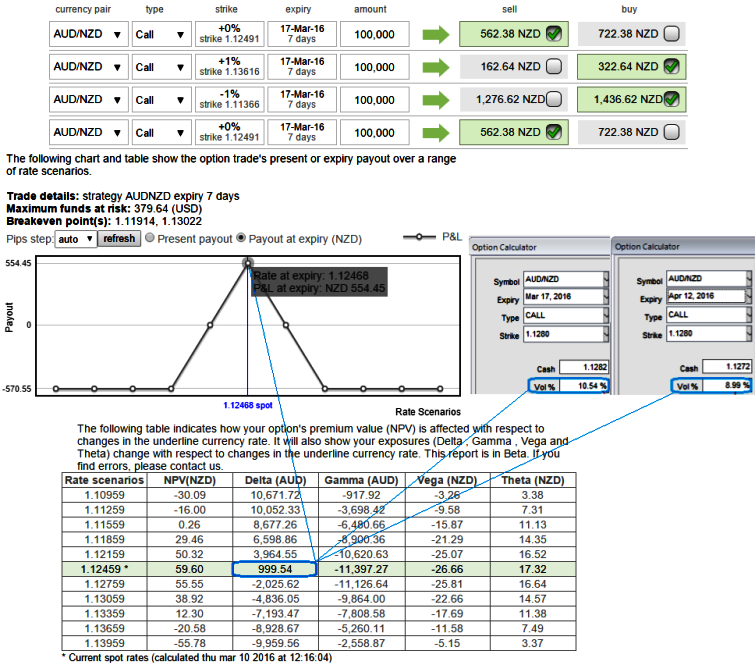

ATM IVs of 1W expiries are at 10.54%, and 8.99% for 1M tenor.

Moreover, technically we see a stiff resistance at 1.1290 and 1.1416 levels.

If IV is high, it means the market thinks the price has potential for large movement in either direction. Low IV implies the market thinks the price will not move much and so that it is beneficial for option writers.

So, the current rallies can very well be interpreted as momentary and resultant effects of RBNZ's surprising rate cut by 25bps in its monetary policy.

A delta neutral trading strategy in this case involves the buying of a theoretically underpriced option (OTM as shown in the diagram) while taking an opposite position in EURCHF options.

Well, thereby, a common question pops up after this explanation, "How do you know if an option is theoretically underpriced?" we prefer to use Option Greeks platform that provides this information.

Comparing reasonable delta contents, ATM IVs and option premiums with net present values of such premiums, will give you the theoretical price of an option.

Here, the implied volatilities of ATM contracts are below 9% for next 1 month tenor.

So if anyone believes it can still be possible to pull out returns from this clumsy atmosphere from this pair, even though exhausted bulls who think long lasting non-stop streak of bull run to take halt at this point. Yes, that's quite achievable from iron butterfly strategy.

Execute the strategy by deploying 1W ATM shorts with positive thetas, simultaneously go long in 1W (1%) ITM call and (1%) OTM call of similar expiries, the position has to be constructed with net delta zero or closer to zero as shown in the diagram so as to fetch you the certain returns on expiration.

FxWirePro: "AUD/NZD premiums on call blowing out of proportion" - delta neutrality strategy for dubious bulls

Thursday, March 10, 2016 7:29 AM UTC

Editor's Picks

- Market Data

Most Popular