- AUD/NZD down 0.57% on the day, hits fresh 2-week lows at 1.1092, bias lower.

- Kiwi is extending stellar quarterly NZ employment report led gains, while a big beat on the Chinese services PMI data for October also lends support to the antipodeans.

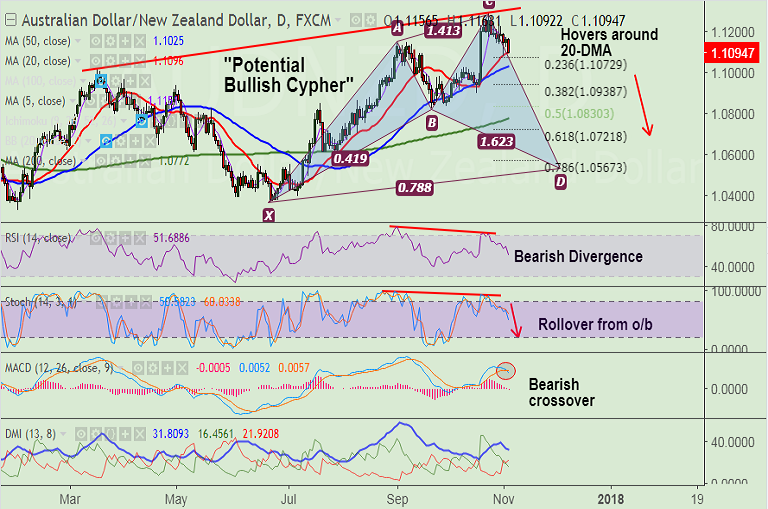

- The pair is extending downside as it completes a potential 'Bullish Cypher' pattern on the daily charts which keeps scope for downside.

- Technical studies are bearish, RSI and stochs biased lower, MACD shows bearish crossover on signal line.

- The pair is currently hovering around 20-DMA at 1.1096, finds next major support at weekly 5-SMA at 1.1082.

- Break below will see further drag. Scope then for test of 50-DMA at 1.1025.

Support levels - 1.1081 (weekly 5-SMA), 1.1072 (23.6% Fib retracement of 1.0370 to 1.1290 rally), 1.1025 (50-DMA)

Resistance levels - 1.1149 (5-DMA), 1.12, 1.1290 (Oct 24 high), 1.30 (trendline)

Call update: Our previous call (http://www.econotimes.com/FxWirePro-Potential-Bullish-Cypher-on-AUD-NZD-raises-scope-for-downside-good-to-short-rallies-974849) is approaching TP2.

Recommendation: Book partial profits at lows. Watch for break below weekly 5-SMA at 1.1025 for further weakness.

FxWirePro Currency Strength Index: FxWirePro's Hourly AUD Spot Index was at 79.8168 (Bullish), while Hourly NZD Spot Index was at 146.213 (Bullish) at 0540 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest