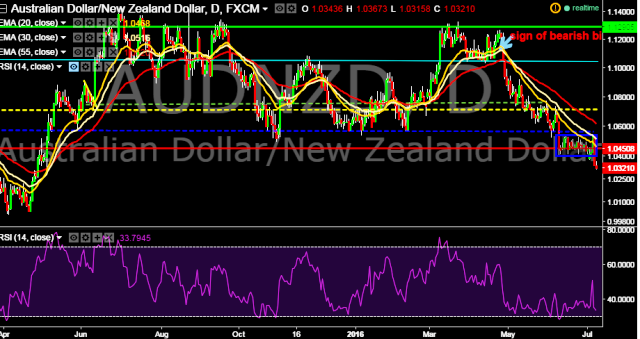

- AUD/NZD is trading around 1.0326 marks.

- Pair made intraday high at 1.0367 and low at 1.0315 marks.

- Intraday bias remains bearish till the time pair holds key resistance at 1.0450 marks.

- On the top side, a sustained close above 1.0450 will drag the parity higher towards 1.0538/1.0647/1.0748/1.0823/1.0976 (January 2016 high) /1.1062 (30D EMA)/1.1123/1.1298/1.1317 levels respectively.

- Alternatively, a sustained break below 1.0315(May 05, 2015 low) will take the parity down towards key supports around 1.0261 and 1.0109 marks respectively.

- Today S&P revises Australia’s sovereign credit outlook down to negative from stable; Current rating is AAA.

We prefer to take short position in AUD/NZD only below 1.0315, stop loss 1.0450 and target 1.0261/ 1.0109 marks.