Aussie dollar after long lasting losing streak that has begun from July, it is now making an attempt of recovery a bit as both technical and fundamental indicators are signaling buying sentiments.

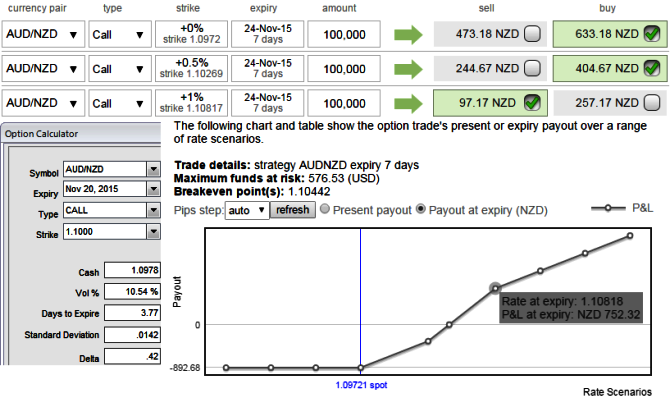

Hence, we recommend it is better to cover all your shorts and as shown in the diagram purchase 1 ATM call, 1 lot of (1%) OTM call and simultaneously short 1 lot of deep OTM call (2%) with shorter expiry in the ratio of 2:1.

The higher strike short calls because IV is inching higher at 11% and it finances the purchase of the greater number of long calls (ATM calls are overpriced, so we chose 1% OTM calls as well) and the position is entered for reduced cost.

Vega on Long ATM Call = 62.05

Vega on Long (0.5%) OTM Call = 57.96

The current IV of AUDNZD call is higher side at 11% which is good for writers, usually if the Vega of a long option position is positive and the implied volatility rises or dips, the above stated option prices are directly proportional to the implied volatility.

So in this case Vega both on long position is reasonably acceptable. It is desirable that at maturity the underlying exchange rate of AUDNZD to remain near short strikes in order to achieve highest returns.

FxWirePro: AUD/NZD higher IV bids writers an opportunity – CRBS hedges extended upswings

Tuesday, November 17, 2015 6:39 AM UTC

Editor's Picks

- Market Data

Most Popular