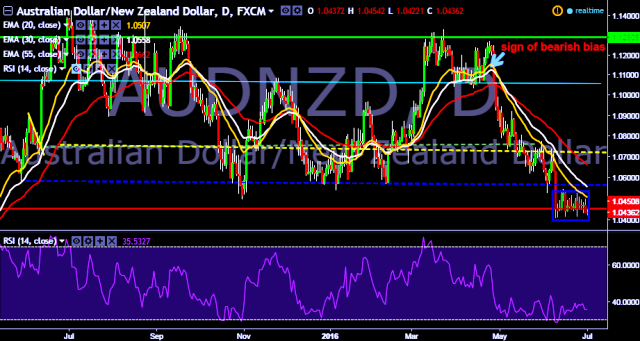

- AUD/NZD is trading around 1.0432 marks.

- Pair made intraday high at 1.0454 and low at 1.0422 marks.

- Short term bias remains highly neutral till the time pair holds key support at 1.0416 marks.

- On the top side, a sustained close above 1.0547 will drag the parity higher towards 1.0647/1.0748/1.0823/1.0976 (January 2016 high) /1.1062 (30D EMA)/1.1123/1.1298/1.1317 levels respectively.

- Alternatively, current downfall will take the parity down towards key supports around 1.0408 (June 9, 2016 low), 1.0362 and 1.0231 marks respectively.

- Important to note here that, 20D, 30D and 55D EMA heads down and confirms bearish trend in a daily chart.

- Australia Jun AIG manufacturing index increase to 51.8 vs previous 51.0.

We prefer to take short position in AUD/NZD only below 1.0416, stop loss 1.0499 and target 1.0362/ 1.0231 marks.