On daily charts, AUDJPY is moving as if moving averages are negatively correlated which could bring in the prices towards north in short term. While RSI and stochastic oscillators are puzzling this uptrend rallies. We think this pair is likely to remain either on sideways or slightly swing upwards but not beyond 89.216 levels. Having said that long term dips are most likely, so as a swing trader with a mindset of gaining these swings on both directions we constructed the below strategy.

Currency Option Strategy: AUD/JPY Short Put Ladder

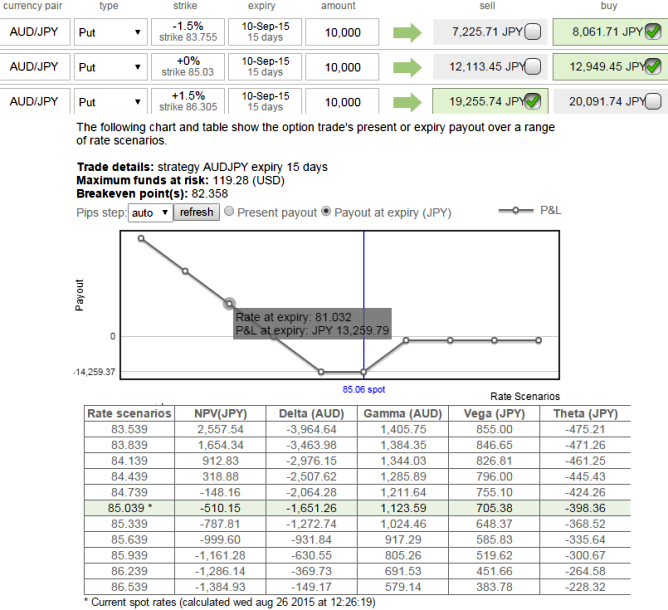

Rationale: unlimited downside and limited upside profit potential

Maximum returns are limited to the extent of initial credit received if the AUDJPY rallies above the upper breakeven point (BEP) but large unlimited profit can be achieved should the underlying exchange rate of AUDJPY makes a vivid downswings below the lower BEP.

How to execute: Short 7D (1.5%) ITM put option and simultaneously add longs on 15D ATM -0.50 delta put option and one more 1M (-1.5%) OTM -0.33 delta put option.

So by buying another put at a lower strike in conjunction with bull put spread constitutes this position, the position assumes uncapped reward potential if AUDJPY plummets.

Maximum Upside Profit = Initial credit received JPY 7238.94

Maximum Downside Profit = Unlimited.

FxWirePro: AUD/JPY short put ladder hedges short term bull run and resumption of bear trend

Wednesday, August 26, 2015 7:01 AM UTC

Editor's Picks

- Market Data

Most Popular