RBA maintains status quo in its today’s cash rates decision, (actual 1.50% against consensus and previous 1.50%), while Australia recorded a current account deficit of AUD 9,125 million in Q3 of 2017, down by AUD 539 million when compared to the same quarter of last year and compared to market expectations of AUD 9,200 million gap.

The balance of goods and services surplus in the September quarter was AUD 3,056 million (- AUD 376 million). Meantime, the primary income deficit fell AUD 1,044 million to AUD 11,968 million.

Trade balance and quarterly GDP data announcement are scheduled for this week on the Aussie side. On the other hand, Japanese CPI and final GDP flashes are also lined up.

While as per the JP Morgan’s projections, AUDJPY is seen at 79 by Q1’2018.

Hedging framework (AUDJPY):

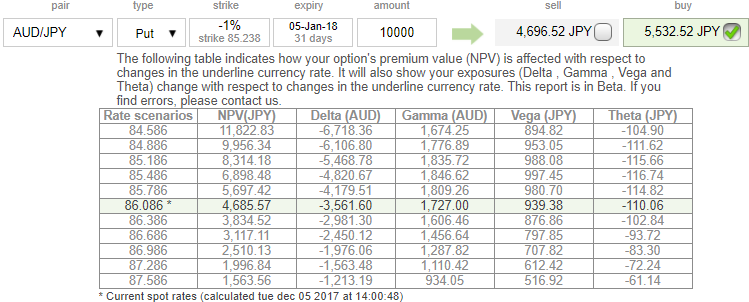

On hedging grounds, risk-averse traders, capitalizing ongoing rallies of the underlying spot FX, we advocate snapping rallies and buying a 6M 84.250 AUDJPY one-touch put.

Please be noted that the 1m ATM IVs of this pair is trading at 12.20%. While OTM put is priced at 6.2% of NPV which is in sync with IVs of this tenor and reasonable contemplating above bearish risk factors.

Those who wish to reduce the cost of hedging; we advocate buying 4M sell 2M AUDJPY put spreads at 86/90.159 strike in 1:0.753 notionals.

Vols of 2m tenors are on the lower side which is conducive for option writers, hence, we’ve chosen ITM striking put as we agree with JP Morgan’s projections.

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards 73 levels (bullish), while hourly JPY spot index was at shy above -20 (neutral) while articulating at 08:36 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close