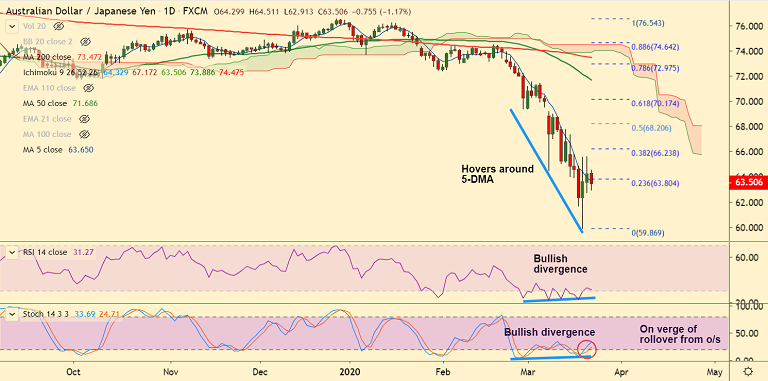

AUD/JPY chart - Trading View

AUD/JPY hovers around 5-DMA, pauses 2 straight sessions of upside, bias turning neutral.

The pair was trading 1.09% lower on the day at 63.50 at around 07:00 GMT after closing 1.06% higher on Friday's trade.

Major trend in the pair is bearish, but a 'bullish divergence' and 'oversold oscillators' hold scope for upside.

Australia's government on Monday announced a second major economic rescue package worth $66 billion, on top of an initial $17.6 billion package.

The pair largely unimpressed. Risk aversion continues to drive markets, weighs on the upside.

TIME TREND INDEX OB/OS INDEX

1H Neutral Neutral

4H Bearish Neutral

1D Bearish Neutral

1W Bearish Oversold

Support levels - 62.706 (Hourly cloud), 59.869 (Mar 19 low)

Resistance levels - 65.175 (200H MA), 66.238 (38.2% Fib)

Summary: Major trend is bearish, but 'bullish divergence' and 'oversold oscillators' hold scope for minor upside. Watch out for break above 200H MA for further gains.

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes