Bearish AUD scenarios:

1) The unemployment rate moves back towards 5.75%, raising risks that the RBA responds to a weakening labour market;

2) The Fed responds to firm labour market outcomes and above-trend growth by delivering a faster pace of hikes than currently expected;

3) China data weaken materially; or

4) The risk markets retrace and vol rises as financial conditions tighten.

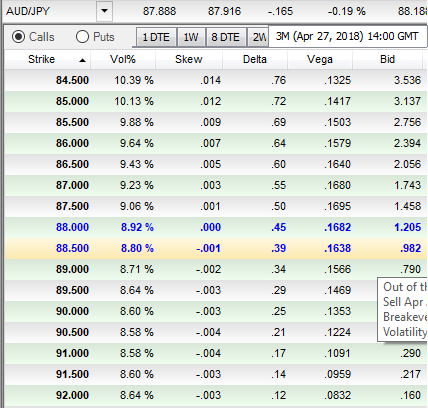

AUDJPY vols of 3m tenors are also at the decent side which is conducive for option holders, while skews have positively stretched on OTM put with attractive gammas, this Options Greek is the rate of change of the Delta with respect to the movement of the rate in the underlying market.

In the sensitivity table, Gamma shows how much the Delta will change if the underlying rate moves by 1%. Hence, we’ve chosen ITM striking put as we agree with JP Morgan’s projections.

Contemplating these aspects, on hedging grounds, risk-averse traders, capitalizing on deceptive rallies of the underlying spot FX, we advocate snapping rallies and buying a 3M 84.250 AUDJPY one-touch put.

Please be noted that the 3m ATM IVs of this pair is trading shy above at 9%.

Those who wish to reduce the cost of hedging; we advocate buying 4M sell 2M AUDJPY put spreads at 89/84.250 strikes in 1:0.753 notionals.

Currency Strength Index: FxWirePro's hourly AUD spot index is flashing at -24 levels (which is bearish), while hourly JPY spot index was at shy above -53 (bearish) while articulating (at 07:19 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025