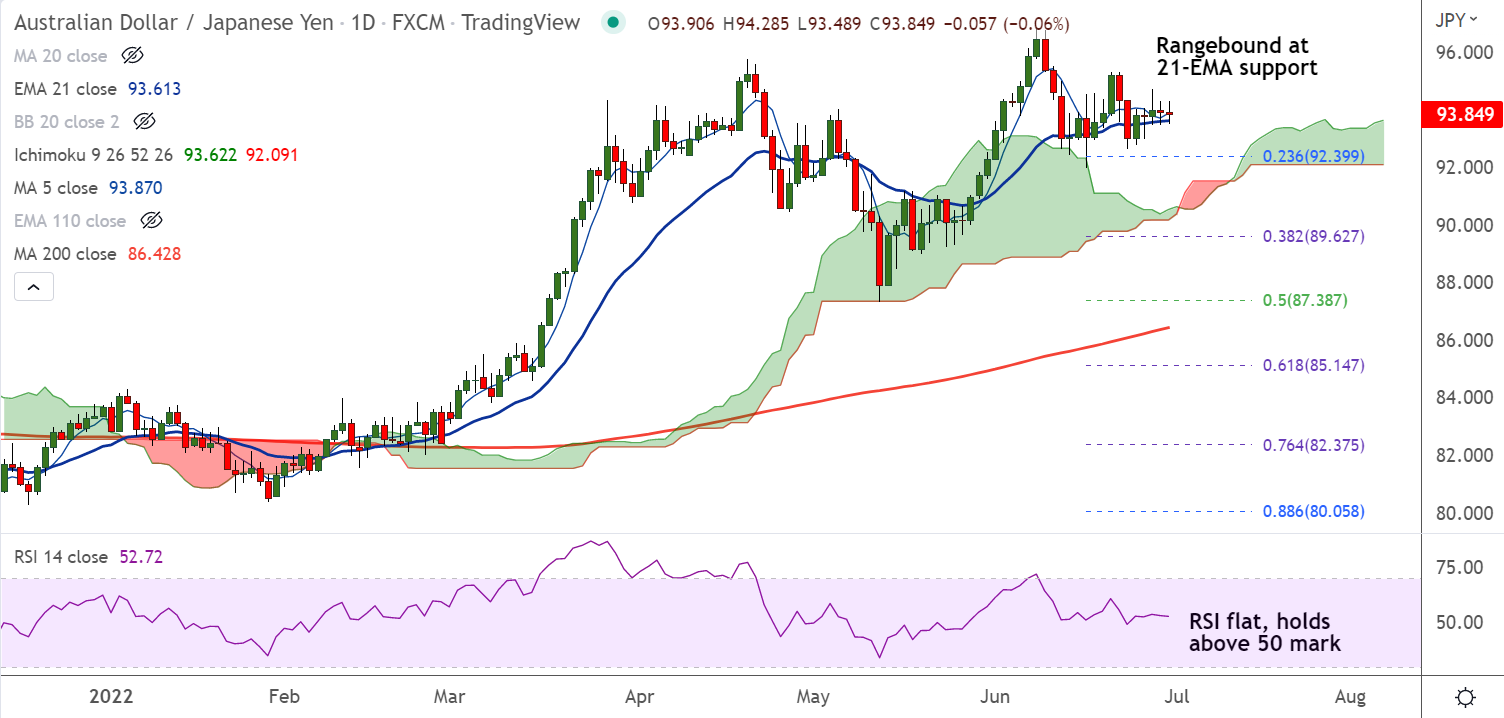

Chart - Courtesy Trading View

AUD/JPY was trading 0.12% lower on the day at 93.78 at around 12:45 GMT.

The pair is extending sideways grind at 21-EMA support, break below will drag the pair lower.

Upbeat China PMI data failed to lend support. Bias remains bearish amid risk-averse market atmosphere.

China’s headline NBS Manufacturing PMI rose to 50.2 versus 49.6 prior, versus 50.4 forecasts. While, Non-Manufacturing PMI rallied to 54.7 versus 52.5 expected and 47.8 prior.

Major trend in the pair is bullish as evidenced by widening Bollinger Bands, but minor trend has gone neutral.

21-EMA is immediate support at 93.60. Break below will plummet prices. Next immediate support lies at 23.6% Fib at 92.39.