Bearish scenarios:

1) The unemployment rate moves back towards 6%, forcing the RBA to respond more aggressively to weak inflation;

2) China data weaken materially.

Bullish scenarios:

1) China eases policy and commodities rebound;

2) The RBA adopts a more hawkish tone to its communications.

So far, RBA outlook seems to be on hold for some time which is anchoring short-maturity interest rates and should keep 3yr swap rates in a 1.8% to 2.3% range, as long as core inflation remains below 2%.

While JP Morgan’s projections of AUDJPY at 81 by Dec’2017, 79 by Q1’2018.

Hedging framework (AUDJPY):

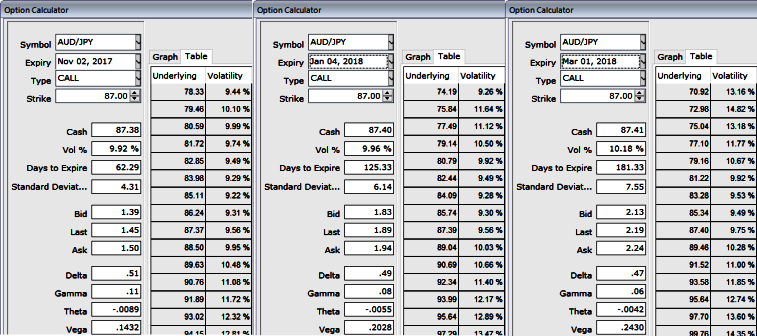

Please be noted that the IVs of ATM contracts are trading at 9.92%, 9.96% and 10.18% for 2m, 4m, and 6m tenors respectively.

On hedging grounds, risk-averse traders, capitalizing ongoing rallies of the underlying spot FX, we advocate shorting a 3M in premium-rebate notional and buying a 6M 84.250 AUDJPY one-touch put.

Those who wish to reduce the cost of hedging; we advocate buying 4M sell 2M AUDJPY OTM/ITM puts at 86/90.159 strike in 1:0.753 notionals.

Vols of 2m tenors are at the lower side which is conducive for option writers, hence, we’ve chosen ITM striking put as we agree with JP Morgan’s projections.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise