After 6-7 months of consolidation pattern now seems to be exhausted at 50% of Fibonacci retracements from the lows of 72.437 levels (Jun’16 lows).

As you could probably make out the upswings on monthly plotting have exactly rejected at 87.533 which is almost 50% Fibonacci retracement levels.

As a result, a shooting star appeared at 84.249 levels at this Fib. level and 21EMA, that is where the leading oscillators (RSI) is also sensing some sort of resistance at 49-50 levels, you observe the leading indicator gaining or struggling for strength in trend at this juncture (refer monthly plotting).

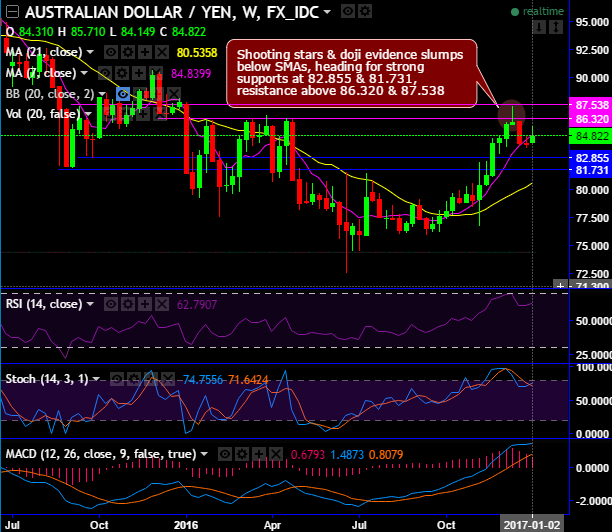

Please also be noted that the shooting star & doji patterns are traced out on daily plotting at 86.102 and 84.124 levels respectively that evidence slumps below SMAs, heading for strong supports at 82.855 & 81.731, resistance above 86.320 & 87.538.

Expect more dips as shooting star evidences slumps that break support below 7SMA.

Trade tips:

Well, contemplating above technical reasoning, on speculative grounds we advise tunnel spreads which are binary versions of the debit put spreads favoring bearish indications.

This strategy is likely to fetch leveraged yields than spot FX and certain yields keeping upper strikes at 85.710 and lower strikes at 84.149 levels.