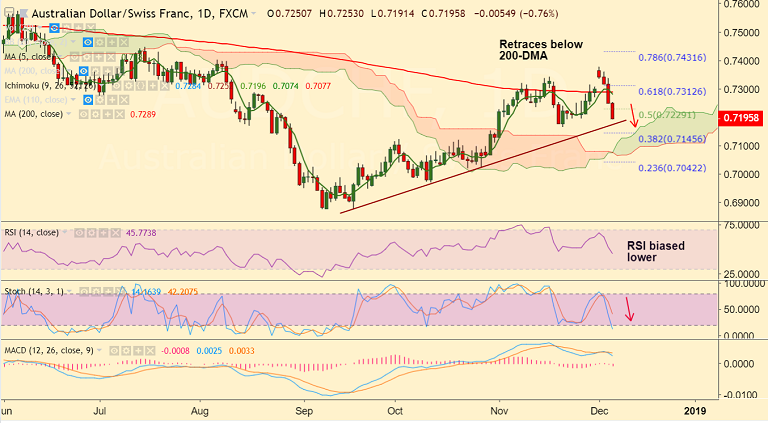

AUD/CHF chart on Trading View used for analysis

- AUD/CHF is trading 0.71% lower on the day at 0.7199 at the time of writing.

- The pair has retraced break above 200-DMA and is extending declined for the 4th straight session.

- Aussies weakens across the board after series of poor data which has strengthened RBA stance to stay pat.

- After dismal Q3 GDP showing on Wednesday, Australia's Trade Balance unexpectedly declined in October.

- Data released earlier today showed Australia’s trade surplus narrowed to A$2.3 billion in October from A$2.9 billion the previous month.

- Traders largely ignored positive retail sales which were up 0.3% m/m in Oct versus a +0.2% forecast and accelerating from the +0.1% in Sept.

- Technical indicators have turned bearish on daily charts, RSI and Stochs are sharply lower.

- The pair has broken below 110-EMA and is holding support at 55-EMA at 0.7193. Break below will see further weakness.

- On the flipside, immediate resistance is seen at 23.6% Fib at 0.7258. Bullish continuation only above 200-DMA.

Support levels - 0.7193 (55-EMA), 0.7166 (Lower BB), 0.7066 (61.8% Fib)

Resistance levels - 0.7243 (21-EMA), 0.7258 (20-DMA), 0.7282 (5-DMA)

Recommendation: Good to go short on decisive break below 55-EMA, SL: 0.7250, TP: 0.7165/ 0.71/ 0.7070

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data