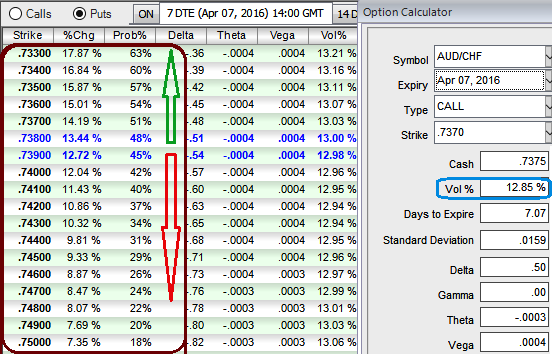

The implied volatility of 1W expiries are spiking at 12.85%.

If you have to evaluate these vols and premiums with probabilistic figures in distinctive scenarios of OTM strikes, the options pricing seems reasonable, which means more likelihood of these puts expiring in the money.

Since the Vega is the sensitivity of an option’s value to a change in volatility, here in case of AUDCHF ATM vega is at 0.0004 and it has been stabilized over OTM put strikes .

It is usually expressed as the change in premium value per 1% change in implied volatility, and if you compare these values with 0.7375 and above strikes both probabilities and vega are less. As a result, we reckon the vega instruments are more conducive in bearish hedging.

You can also observe the performance of these contracts (see %change in premiums).

Technicals also say, AUDCHF bearish swings have been traveling in sloping channel with a distance of around 1500-1700 pips.

From last 5 days attempts of spike has now been struggling at 0.7382 levels, it has bounced from 0.7302 to 0.7403 levels (today's high) in last 5 days.

We now emphasize "0.7382" areas as stiff resistance of sloping channel as shown on the monthly graph.

With above technical reasoning, use this strategy as AUD/CHF long term bearish environment holding stronger despite intermediate attempts of bulls taking over rallies and wish to earn capital gains.

Currency Hedging Framework:

Considering above reasoning, downtrend in long term is certain but because this is heading channel resistance, we want to play it safe and are capitalizing a bit on this ongoing downtrend by using recovery rallies with an objective of profit maximization.

The rationale: Any potential downswings should be optimally utilized during high volatility times, so as to participate in that downtrend, weights in the portfolio should be doubled with ATM puts in order to give the leveraging effects. The profitability can be maximized for every shift towards downside and this is not the same on upside.

Hence, Weights are to be more to cushion downside risks as a result, we recommend holding 2W at-the-money 0.51 delta call and simultaneously hold 2 lot of 1M at-the-money -0.49 delta put options.