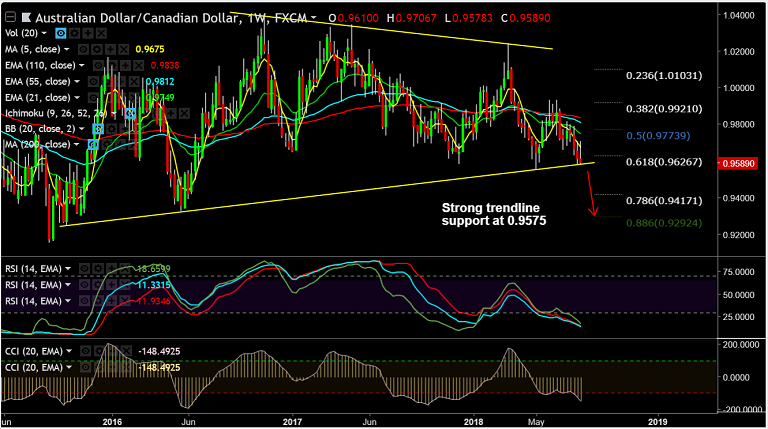

Refer AUD/CAD chart on Trading View

- AUD/CAD slumps 0.73% on the day, trades at 0.9551 at the time of writing.

- The pair is extending declines for the 4th straight week, bias remains bearish.

- Aussie on the defensive as the Reserve Bank of Australia trims inflation forecasts.

- The RBA trimmed the December 2018 underlying inflation forecast to 1.75 percent and now sees inflation at 2 percent in December 2019 and 2.25 percent in December 2020.

- Technical indicators are bearish. AUD/CAD has shown a breach at major trendline support at 0.9575.

- Close below trendline support to see further weakness. Next major bear target lies at 78.6% Fib at 0.9471.

- On the flipside, 5-DMA is immediate resistance at 0.9628. Break above could see test of 21-EMA.

- Focus on today’s Canadian employment data due on the cards at 1230 GMT.

Support levels - 0.95, 0.9417 (78.6% Fib), 0.9396 (Dec 2014 low)

Resistance levels - 0.9628 (5-DMA), 0.9666 (21-EMA), 0.97

Recommendation: Stay short on close below trendline support, target 0.95/ 0.9420/ 0.94

FxWirePro Currency Strength Index: FxWirePro's Hourly AUD Spot Index was at -135.738 (Bearish), while Hourly CAD Spot Index was at 25.8833 (Neutral) at 0630 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.