The FX volatility is very low and turnover suggests that participation is also declining. This is highlighted by the tight ranges in FX despite substantial reversals in both equities and debt markets. We reckon the stasis in the FX market is symptomatic of a market approaching a pivot point.

Dual changes are likely, the first one is that the dollar, which has been the dominant driver could be giving way to risk appetite again, as the market throws in the towel on its weaker USD views yet again. With risk appetite in other markets ‘euphoric’, this tilt could well drive a substantial rise in FX volatility.

The latter potential change is that the FX market may drift away from trading in a top-down fashion. As divergences appear between both the outlook for growth in economies and the reaction function of central banks, we think a bottom-up approach to the market could become the path to success.

As the bearish trend in FX volatilities continues, the appeal of buying optionality at low entry levels clashes with the negative time decay options suffer when catalysts for higher realized vols are missing.

We try to shed some light on the perennial debate between tactical vs strategic vol investment approaches by updating a systematic FX short-vol trading model introduced in March. As we write, the model would largely keep the short-vol bias.

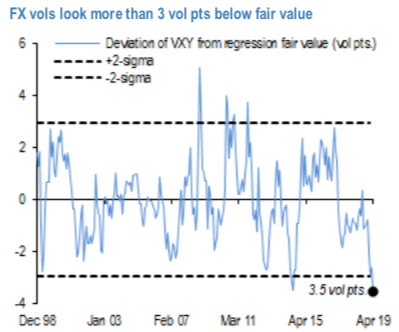

Despite the rebound as occurred during the last week of April, FX vols remain near historical lows. Current volatility levels appear more than 2 std.devtn. undervalued based on the J.P. Morgan cyclical fair value for FX vols (refer above chart). In this market characterized by ultra-depressed volatility levels, the strategic appeal of holding long-optionality positions clashes with the multi-month trend dragging vols even lower, thus impacting long positions via time decay.

In the first part of this note, we update a systematic FX short-vol model as released earlier this year, for shedding some light on the perennial debate between tactical vs strategic approaches when managing vol trades.

Also, it appears natural to look for possible catalysts towards higher FX vol levels by investigating relationships involving other asset classes, as done for instance in the J.P. Morgan View, the rolling bear market in volatility. In the second part of the note, we focus on the possible relationship between FX and rates vols. Courtesy: ANZ & JPM

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 77 levels (which is bullish), USD is at -8 (neutral), while articulating (at 08:23 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty