Gold (often perceived as a safe-haven) has extended recent gains and is on the verge of approaching its 3-year range highs. The US equities remain in a holding pattern near their recovery highs, just under all-time highs in the case of the S&P500. US yields have come back under pressure towards this years lows, while the USD has rebounded back to mid-range ahead of today’s key retail sales data. The US 10yr treasury yields fell from 2.12% to 2.08%, while 2yr yields fell from 1.87% to 1.82%. Markets are pricing a 100% chance of a Fed fund rate cut by July (was 90% yesterday), with a total of three cuts priced by December.

Gold prices are glittering above $1,350 level and hit a fresh 1-year high. Buying sentiments are intensifying as geopolitics in addition to the monetary policy season have moved back into the spotlight, with the US Secretary of State Mike Pompeo saying Iran was involved in yesterday’s attack on an oil tanker in the Persian Gulf. While the level of nervousness at the Fed certainly seems to be going up and so its message will likely be more ‘dovish’. The US central bank will probably leave interest rates unchanged at the June policy meeting.

OTC Updates for Bullion Market:

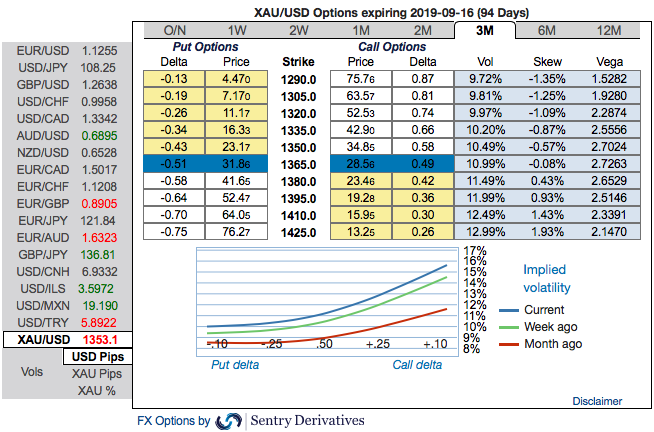

Please be noted that the positively skewed IVs of 3m XAUUSD contracts are still indicating the upside risks. One could see a bullish risk reversal setup. To substantiate the above bullish sentiment, positive addition to the risk reversal (RRs) numbers indicate an overall bullish environment.

The above risk reversal numbers have been known as a gauge of gold’s underlying market for bullish opportunities. Well, we know that options are predominantly meant for hedging a probable risk event in the future.

Options Strategy: Capitalizing on the prevailing dips of gold price in the short-run and OTC indications, bullish neutral risk reversals of gold, we advocate longs in gold via ITM call options.

Buy 3m XAUUSD (1%) ITM -0.69 delta calls on hedging grounds. If the expiry is not near, delta movement wouldn’t be 1-point increase with 1 pip in the underlying movement, which means if the spot moves 1 pip, depending on the strike price of the option, the option would also move less than 1. Thereby, in the money call option with a very strong delta will move in tandem with the underlying.

Alternatively, on hedging grounds, we advocated long positions in CME gold contracts. We now like to uphold the same strategy by rolling over the contracts for July’19 delivery as we could foresee more upside risks. Courtesy: Sentrix & Saxo

Currency Strength Index: FxWirePro's hourly EUR is at -105 (bearish), hourly USD spot index is inching towards 169 levels (highly bullish), while articulating at 14:39 GMT.

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms