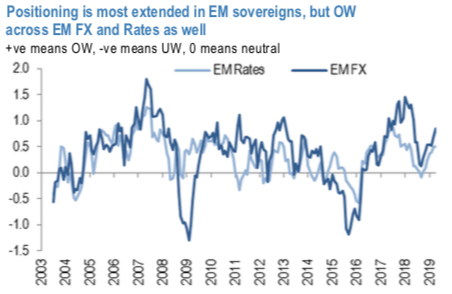

After a strong technical position in 1Q, 2Q look set to weaken. One similarity to 2018 for EM markets is the fact that we enter May with consensus OW positioning that has been built up and following large inflows. JP Morgan’s latest EM Client Survey on positioning shows that investors have added risk this year and have increased OW’s (refer to 1st chart).

The OW positioning is not that stretched relative to history (15y Z scores +0.71). Aside from positioning, EM retail bond flows have become less supportive in recent weeks and are now at their lowest weekly pace this year. The slowdown in EM retail bond flows is not too surprising given weakening return momentum.

Well, we have emphasized a piece for timing FX short-volatility trades across different currencies: this was the JPM’s approach pursued at the beginning of March, that is the one of maintaining the short-vol bias unless a number of cross-asset or asset-specific indicators flag a deterioration of risk conditions.

The latest signals, i.e. the decision made on the latest trades at the inception, based on the model would recommend selling volatility at the maximum allowed notional on all currencies overviewed.

We remind readers that, in the current framework, we enter new vol trades on a daily basis, keeping them in the book until expiry (the back-tests displayed later refer to the performance of 1M 25-delta strangles for all currencies considered).

Basically, at any point in time, the outstanding position in the vol book is the result of the trading decisions as made over the past month. The current allocation to short-vol strategies for the different currencies is reported in 2ndchart: we could see from the chart that the current allocation ranges from near 100% for some currencies to 72% for USDTRY, 83% for cable, 85% for USDHUF.

Obviously, as it will be clear later when considering a few case studies, this results from the fact that the model was recommending to scale down the traded notionals as G10/EM vols had started to creep higher around mid-April. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly USD is flashing at 16 (mildly bullish), hourly EUR spot index is creeping upwards at 39 levels (which is mildly bullish) while articulating (at 07:16 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data