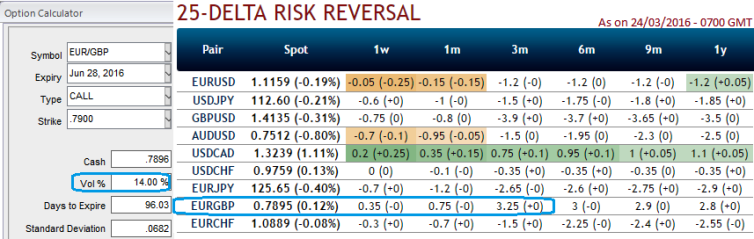

With the adjustment to the IVs, risk reversals and next significant event that can have the major impact on EURGBP would be UK referendum (that is scheduled 2 months from now), 3M IVs of EURGBP are still conducive for call option holders contemplating risk reversals.

Bearish GBP –rotated from GBP/CHF to EUR/GBP after the ECB meeting

A record w/w build in GBP longs provided for the bulk of this week’s $3.2bn improvement, leaving GBP vulnerable in the event of a renewed decline.

Hedging bets:

While delta risk reversals are still flashing up progressively with positive numbers that favours bulls and indicates they are willing to pay OTM strikes in higher vols.

Since, IVs of ATM contracts are at higher levels with positive risk reversals would mean that calls have been overpriced relatively to the puts.

During Brexit scenario, at spot FX of EURGBP is trading at 0.7911, and is anticipated spike up moderately in the months to come, so it is better to hedge by going long in far month at the money calls with 50% delta, simultaneously, short 1M (1%) in the money put with positive theta.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings