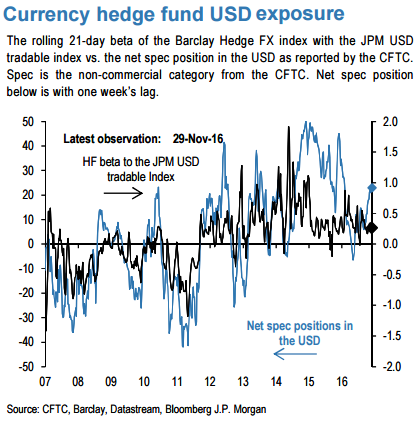

The above performance picture, we get from the monthly reporting hedge funds is quite disappointing than the picture from the daily reporting funds as even currency hedge funds performed poorly in November.

As you could observe the rolling 21-day beta of the Barclay Hedge FX index with the JPM USD tradable index vs. the net spec position in the USD as reported by the CFTC. Spec is the non-commercial category from the CFTC. Net spec position below is with one week’s lag.

Fed package: The FOMC proved more hawkish than markets anticipated, with the dots shifting to reflect a total of three hikes during 2017. This hawkishness helped to mitigate some of the underperformance of treasury yields such as ZAR 10-year payer trades, as rates were paid up across emerging markets while EM currencies deteriorated.

Over the near term, some positive political dynamics and technical forces may continue to bolster ZAR resilience. Domestic and external factors point in divergent directions, underscoring the importance of trade entry levels.

ECB’s shift: An ECB tapering scenario by 2018, our house view, creates a big demand cliff for global bond markets in 2018, unless supply collapses at the same pace as demand, which seems rather unlikely, or demand outside G4 central banks picks up quickly, something that is more likely to happen only after a big increase in bond yields. An alternative scenario where the ECB tries to preserve ammunition would prolong QE to beyond 2018.

A smoother QE reduction profile is also important because this week’s ECB decision involved not only a reduction in the pace of purchases but also a shift in purchases towards shorter maturities which implies less duration withdrawal.

The USD surged higher, aligned with US yields on the back of the Fed not only raising rates by the expected 25bps, but increasing their expectations for three more hikes next year, from two. They expect jobs growth to strengthen further and inflation to pick up towards their 2% target.

As a result, Long-term the move down through the 1.0450 region is arguably the last in the cycle from the 1.6020 highs set back in 2008. If this is the case the market should not breakdown through the 1.01-0.99 region. Such a move would expose a deeper rift in the EUR and risk a move towards 0.90.

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices