The FX markets have calmed down a little, particularly commodities, as trade data from China showed exports picked up a little more than expected, but imports slackened off much more than expected. US equities remain an outperformer, with the NASDAQ leading the way, setting new all-time highs as we head into earnings season.

Meanwhile, the US treasury curve continues to creep ever closer towards inversion (when shorter-dated yields are more than longer-dated debt yields - historically this has warned of an impending recession).

Last night, Fed Chair Powell said the US economy was in a "really good place" with a strong labour market and prices around their targets. He did say that the Fed is hearing rising concerns in regards to trade wars and its potential impact on the economy. We should get a more granular outlook from him next week at his semi-annual testimony to Congress.

While the dollar has continued to strengthen. The bulk of USD strengthening has come against EM currencies, but performance has outperformed most currencies in G10 as well.

Regional divergences in G10 reflect EM biases with Asia-linked and defensive currencies (AUD, CHF and NZD) outperforming vs USD in the past month, but Euro area-linked currencies (EUR and SEK) weakening the most.

The rankings of currencies on this framework are mostly unchanged this month. A shift has come from CHF, which given recent outperformance has ended up moving up in rank (from third cheapest currency to the fourth cheapest), but nonetheless, valuations are midrange rather than at an extreme thus leaving the currency with two-sided risks.

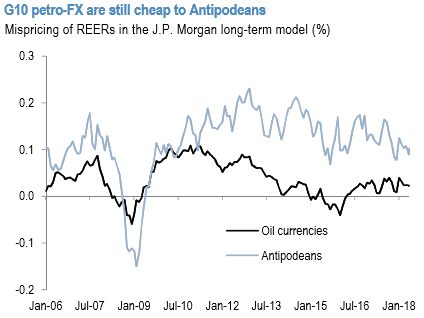

The cheaper basket continues to be dominated by SEK and GBP in G10, while the richer end of the spectrum still comprises USD, EUR and the Antipodeans. Petro-driven FX in this framework continues to screen near fair value but still appear cheap vs. the Antipodeans (refer above chart). Courtesy: JPM

Currency Strength Index: FxWirePro's EUR spot index has shown 54 (which is bullish), while USD is flashing at 122 (bullish) while articulating at 12:48 GMT.

For more details on the index, please refer below weblink:

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand