The minutes from Riksbanken’s monetary meeting on 2nd July showed that Riksbanken’s Executive Board members, who kept the repo rate unchanged at -0.25% at the meeting, emphasized that uncertainties in the international economy has increased recently, in particular, due to the trade conflict between the US and China.

All board members supported the decision to leave the repo rate and the forecast for the repo unchanged, but there were some differences of opinion as to the exact timing of the next rate hike.

Furthermore, in this write-up, we run you through squeezing bullish NOKSEK risk reversals (unwind 1w ATM call; stay short NOKSEK put).

Since referring to the JPM's analysis at the beginning of this year, the trading strategy on NOK has been tactical even though it has consistently been the preferred high beta G10 currency given the resolute central bank stance and improving fundamentals. The approach has been tactical given the tenuous global macro trading environment amid US-China trade negotiations and its implications for high beta FX in aggregate.

The latest expression of long NOK exposure is expressed vs SEK in options in anticipation of a dovish Riksbank outcome as well as the standpoint on SEK reactions in various scenarios. The outcome of that Riksbank meeting ended up being on the hawkish side of expectations with the RB keeping its rate path unchanged in contrast to dovish market expectations, but we nonetheless retained exposure to the long NOKSEK view given cheap valuations and since the next Riksbank hike was still at least six months away and SEK still among the worst yielders globally.

This rationale continues to hold and thus our medium-term expectation is still for NOK to outperform SEK.

However, the structure of the recommended trade (long 1m 1.0980 calls; short 2m 1.08 put) warrants some tweaking. The call which is now ATM is now scheduled to expire next week leaving the trade very sensitive to interim volatility over this period. In the meanwhile, most of the residual value of the trade comes from the short 1.08 NOKSEK put (worth 16bp with 1m left to expiry).

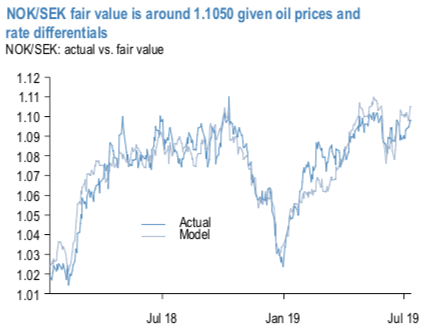

Given our bullish bias on NOKSEK, we continue to stay short the NOKSEK put. The short-term models puts NOKSEK fair value at 1.1050 given current oil prices and rate differentials (refer above chart). Courtesy: JPM

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics