Strong directional views around the USD/Asia outlook were generally absent, but there is a slight skew for pro-risk trades to start 2020. Short USDCNH appears to be a widely held consensus view (as well as position) for a Phase I deal in late’19/early’20. The most bullish scenario painted was one of a trade truce, cyclical lift and early 2020 portfolio inflows into the region.

However, even under this scenario, most clients still wished to ‘buy the dip’ in USDCNH sub 7.00. Delay in the publication of the US Treasury report is widely viewed as a sign that a ‘currency clause’ is being negotiated as a part of any Phase-I deal. Few saw structural positives for the Chinese currency, even if next year delivers a better portfolio inflow set-up with CGB inclusion in global bond indices. The domestic bid for offshore assets was expected to continue, whilst limited degrees of freedom from a policy standpoint (currency clause in a Phase-I deal) was seen as an additional constraint on the extent to which FX could rally. All in all, we got very limited pushback on the idea that longer term CNY depreciation pressures are still likely to be prevalent.

Long KRW was seen as the best expression of a ‘risk on’ tone for EM Asia markets in Q1 next year, in contrast to our lack of enthusiasm around a bullish won stance relative to other Asian FX. The more constructive won outlook was cantered more on global factors rather than Korea specific ones. Most clients felt that current levels of USDKRW were too high for a view of moderate global growth revival in 1Q’20, and were surprised at the poor recent price action in the won. There was also some push back on our long TWD/KRW trade recommendation, on the basis that TWD could underperform in the scenario of a broad risk on rally. Clients are watching the tech cycle closely and wanted to understand the differences in the nature of tech output between Korean and Taiwan.

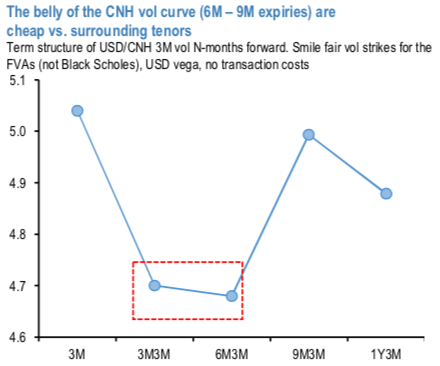

Trade tips: We take the opportunity afforded by the decline in CNH vols late in the week following the positive headlines on a US/China Phase-I deal to enter into a forward vol long in the model portfolio: Buy USDCNH 28-Feb-20 to 24-Jul-20 FVA @ 4.75/5.05 indicatively. Such structures also have the happy relative value edge of buying the belly of the USDCNH vol curve that is cheap to surrounding tenors (refer above chart).

USD call calendar spreads: The net positive theta profile of the calendar spread is consistent with that view, the run-up to the Phase I US/China trade deal is likely to be more reliably characterized by lower FX volatility than a full-throated embrace of carry trades, and allows us to better wear the long TWD/KRW cash position in the EM Asia portfolio that is bleeding negative carry at the current levels of FX implied yields.

On this basis, we advocated the following option structure: Sell 3M 1200 strike USD call/KRW put one-touch option vs. buy 6M 1200 strike USD call/KRW put one-touch option, equal USD notionals for net 14% USD (individual legs 32.6% vs. 46.6% indic), (at spot reference while advocating 1165.50). The short-leg has fetched the desirable yields, long leg likely to take over in the H1’2020. The net premium of 14% rolls up to 32.6% in 3-month time (2.3x carry gearing) if spot, forwards and vols were to remain unchanged. Courtesy: JPM

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts