The central banks continued to create new money; the ECB remained intent on soaking up steady amounts of European debt. Ahead of tomorrow’s ECB policy announcement, when news on the PEPP purchase programme is widely expected, euro area government bond yields are a couple of bps higher across the board this morning. German unemployment data for May and the Eurozone for April are both expected to show significant rises.

EURCHF continued its slide higher amid a broader more optimistic tone in risk markets and risk currencies. The EUR leg proved to be problematic for our trade this week as well on news of the EU Commission’s recovery fund which at ended up being larger than the Franco-German at EUR 750bn of which EUR 500bn would be funded via joint issuance. The proposal has understandably been viewed favourably by markets, but we still think that the process of getting approvals and forming consensus on such a fund will be messy, particularly given the distribution of the individual countries.

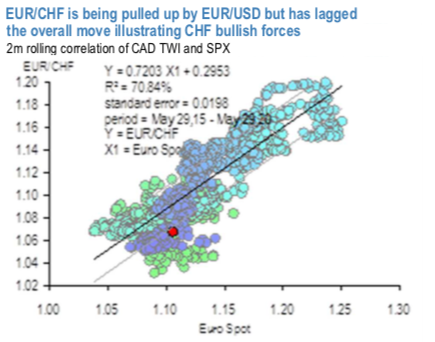

Admittedly, EUR is be temporarily buoyed by this proposal, we expect EURCHF to be relatively more insulated from this move in EURUSD. The basis for CHF longs is structural the inability of Switzerland to generate private sector capital outflows to recycle its outsize current account surplus in a world dominated by QE and broad-based financial repression.

The 1st diagram shows that 1) EURCHF is being pulled higher by EURUSD; but 2) in level terms EURCHF is lower than would be warranted by the level of EURUSD, demonstrating the bullish CHF dimension to the trade. As a result, we keep exposure to this trade.

Bidding 3m positively skewed IVs and risk reversals that are indicating brief upside and downside risks in the major downtrend continuation, accordingly we advocate diagonal debit put spread strategy comprising of both short and longs in optionality with shorter tenor on short leg and longer tenor on long leg.

The execution: Capitalizing on the prevailing minor upswings in the short-run, stay short in 1m (1%) OTM put option with positive theta (position seems good even if the underlying spot goes either sideways or continues prevailing rallies mildly), simultaneously, add long in delta long in 3m (1%) ITM -0.79 delta put options.

Alternatively, on hedging grounds, stay short in EURCHF futures contracts of mid-month tenors ahead of ECB, spot reference: 1.0796 levels (while articulating). Courtesy: Sentry, Saxo & JPM

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts