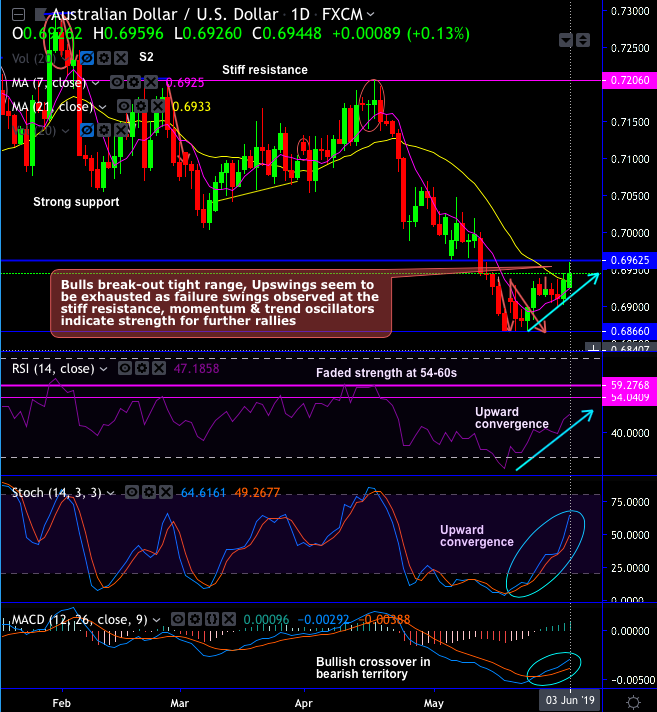

Although AUDUSD broke-out above its five-day consolidation range of 0.6900-0.6940 areas, it’s questionable how far it can run given the mounting trade tensions plus an RBA cut looming.

The contrarian perspective on the Aussie dollar of late has been that a combination of Chinese stimulus and the US-China trade relations would drive the currency. The recent developments on this front have been mixed; generally, China data has printed with a better tone, and quite a few economists have revised up their 2019 calendar year forecasts in the recent past for Chinese growth to 6.4% (from 6.2%). However, the news on the US/China trade deal has soured this week, with heightened risk the US announces an increase in tariffs on $200bn of Chinese imports. Australia has exposed their trades to China (Australia’s major trade partner has been China).

The medium-term perspective: The pair’s range-trading within 0.7000-0.7200 from February to mid-April was finally punctured by Australia’s weak Q1 CPI, which stoked RBA easing expectations.

The Aussie took another leg lower as the rise in the unemployment rate in Apr appeared to seal the case for RBA action. But there has been limited follow-through below 0.6900. Australia’s commodity price basket has rebounded sharply since early April, consistent with historically very large trade surpluses.

Following the signals in RBA Governor Lowe’s speech earlier this week, we have revised our forecast for RBA cuts, from Aug & Nov to Jun & Aug.

We expect 3yr swap rates to a range between 1.25% and 1.50%, with an important aspect of our forecast being that swap rates across the curve will remain “lower for longer”. If the cash rate gets to 1%, as we expect, and with the market not expecting a rapid return to tightening, then 3yr swap rates are likely to consolidate at the lower end of our forecast range.

In addition, the case to be constructive AUD seems to be even less compelling now, with risks around an escalation of trade risks offsetting better news on Chinese growth.

A$ rallies should be capped by RBA rate cuts in this week’s monetary policy and August monetary policy as well, in addition, by the deterioration in US-China trade relations, but with OIS markets already priced for a sub-1% cash rate by 2020, as a result, we could foresee AUDUSD only down to 0.67 levels by September.

Hence, it is wise to snap deceptive rallies of AUDUSD at that juncture to build short hedges by shorting futures of mid-month tenors ahead of RBA monetary policy that is scheduled for this week, as the AUD in the broader perspective still appears to be vulnerable.

On the flip side, as both the momentum and trend oscillators on daily term indicate strength for further AUD rallies, intraday or short-term traders can participate in the prevailing rallies of this pair by buying one-touch calls using upper strikes at 0.6962 levels. Courtesy: JPM & Westpac

Currency Strength Index: FxWirePro's hourly AUD is flashing at 59 levels (bullish), while hourly USD spot index was at -28 (mildly bearish) while articulating (at 08:14 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices