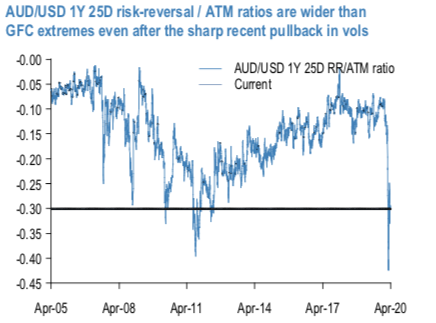

Even after the 50% pullback from the manic extremes of March, AUDUSD risk-reversals are at 2008 GFC extremes as a ratio to ATM vols (refer above charts). The short-memory of the unhinged collapse in AUD spot and spike in AUD vol in March likely has everything to do with this extreme pricing, since realized spot-vol correlation has halved from YTD wides (trailing 30-day % spot vs. 1Y ATM corr running at - 40% at present vs. -80% at the 1Q peak) and is clocking below SABR-calibrated spot-vol corr. implied by the 1Y AUD skew (-55%). Risk premium in option prices after a market crash is not uncommon; the oddity in this case is the extreme nature of the distortion, and the persistence of this fear even after broader risk markets have retraced to the extent that they have.

We have long held the view that AUD vols and skews have lost their ability to erupt explosively like they did during the GFC, so the price action in AUD options in Q1 came as a shock. The downbeat view on AUD’s reduced risk beta is informed by the changing structure of the Australian economy with the petering out of the China-led commodity boom, the attendant RBA rate cuts to cushion its economic impact and the drop-off in carry-seeking flows that left little by way of one-sided length (indeed speculative positioning has been short AUD for much of the past two years, basis CFTC data) at risk of a deleveraging rout – hence, our surprise at the speed and scale of the AUD rout in March. Structural arguments for AUD’s dampened risk- beta could not have changed in a month of course, but aside from option markets offering enormously better levels for re-selling AUD options, the raft of DM policy interventions that have likely curbed the worst tail outcomes, and a significant build-up in USD longs that may slow the speed of additional gains, we also take comfort from the shifting contours of the in-house JPM view around AUD which has turned less bearish in recent weeks as RBA QE begins to look distinctly lighter than elsewhere in G10-FX-bloc.

Stretched riskies/ATM ratios are well faded via vega- neutral ratio AUD put spreads. Such delta-hedged ratios have a solid long horizon track record of delivering alpha, with materially better Sharpes than short ATM straddles. A good part of the better risk-reward of ratio put spreads vis- à-vis straddles is explained by their vega-neutral setup (100:150 notional ratio for ATM vs. 25D puts), which is market-neutral to a greater degree and offers some protection against drawdowns during fierce risk-offs.

Buy AUDUSD 3M ATM vs. sell 3M 25D AUD put/USD call, 100:150 notional ratio, delta-hedged @ 11.45 choice vs. 13.4 / 14.2 indicatively, spot reference: 0.6514 levels. Courtesy: JPM

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms