OPEC would seek agreement on Friday to boost oil output amid calls from major consumers to prevent a supply shortage and despite opposition from group member Iran, which faces export-crippling U.S. sanctions.

Today’s the most eye-catchy economic event is debatably the OPEC meeting in Vienna, wherein, OPEC members, Russia, and other major producers are likely to ease supply constraints that have been in place since January 2017. While the other reports from the preliminary meetings suggest that an increase in production should be seen, although this could still be blocked.

The US, China, and India have recently put pressure on their suppliers to increase supply and ease the pressure from the rapid rise in oil prices (Brent oil recently traded above $80/bbl).

Talk has been for a 1mln-1.5mln bpd increase, but it is more likely that the final number maybe near 600k and that’s if the decision doesn’t get blocked.

Ongoing Call19 producer hedging is likely sustaining a bid for riskies in these longer expiries and a meaningful weaker re-pricing is not expected anytime soon; instead, it is the steady drip of smile decay that is likely to supply the bulk of the returns.

The most thrifty option expression that takes advantage of the two distortions mentioned above is a short Jun'19 OTM 30D-35D strike (strike $70/bbl) put vs. long Jun'20 ATMF straddle (strike $69.25/bbl) Vega-neutral calendar spread(all legs delta-hedged, notional ratio 150 lots of the put vs. 50 lots/leg of the straddle).

The net structure is theta-earning by construction, but with the cover of a Vega hedge behind the short leg that dramatically improves the risk-reward of naked vol selling.

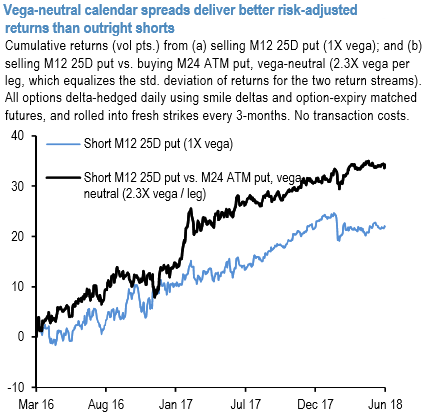

The above chart illustrates return streams from an outright M12 put and the same put hedged Vega-neutrally with an M24 ATM option: the improvement in risk-adjusted returns is palpable, with Sharpe ratios rising from 1.0 to 1.6, and average annual return /max drawdown ratio jumping from 1.4 to 2.4 over the sample period (not inclusive of transaction costs).

Off Jun’19 and Jun’20 future refs. 72.98 and 68.55, sell 70 strike Jun’19 put @ 26.45 vol indic. (premium $6.55/bbl) vs. buy Jun’20 ATMF straddle @ 22.8 vol indic. (premium $8.47/bbl) in 140:100 lots ratio (Vega-neutral). Both legs require active delta-hedging. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis