Global trade headwinds are suddenly gusting stronger and pose distinctly-negative risks to CAD. Despite the seminal shift in monetary policy, CA rate spreads have actually compressed somewhat since the BoC meeting, following concerns on US inflation and global trade.

Furthermore, Canada remains distinct in that it not only faces adverse consequences from a US-China fallout but is exposed to trade risk on the North American front as well. We’ve long been documenting the risks surrounding USMCA / NAFTA 2.0 ratification, with a particular emphasis on bipartisan divide which risks triggering a NAFTA 1.0 pull-out.

Most importantly, Canada is scheduled to announce its trade balance today during US session, the Canadian trade deficit narrowed sharply to CAD 0.97 billion in April 2019 from a downwardly revised CAD 2.34 billion in the previous month and compared with market consensus of a CAD 2.8 billion shortfall. It was the smallest trade gap since October last year, as exports increased 1.3 percent mainly due to higher sales of gold while imports fell 1.4 percent mostly on lower purchases of aircraft.

CADJPY has been dipping from 82.902 to the current 82.029 levels, now slid way below 21DMAs. Overall, the major downtrend is now resumed again with more downside traction in the days to come.

OTC Updates and Options Strategy:

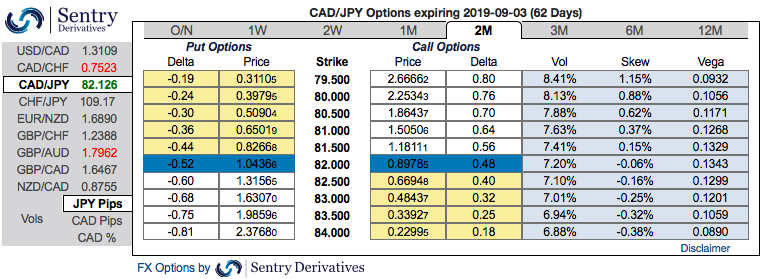

The positively skewed CADJPY IVs of 3m tenors have still been signaling bearish risks, the hedgers’ interests to bids for OTM put strikes up to 79 levels indicating downside risks in the medium terms (refer 1stchart). Please observe above technical chart for the major downtrend.

Accordingly, we advocated options strips strategy to address any abrupt upswings in short-run and the major downtrend.

We’ve been firm to hold on to this strategy on both trading as well as hedging grounds, unlike spreads, combinations allow adding both calls and puts at a time in our strategy.

Buy 2 lots of 3m at the money delta put option and simultaneously, buy at the money delta call options of similar tenors. It involves buying a number of ATM call and double the number of puts. Please be noted that the option strip is more of a customized version of options combination and more bearish version of the common straddle.

Huge profits achievable with this strategy when the underlying currency exchange rate makes a strong move on either downwards or upwards at expiration, but greater gains to be made with a downward move. Hence, any hedger or trader who believes the underlying currency is more likely to spike upwards in short run but major downtrend can go for this strategy. Cost of hedging would be Net Premium Paid + brokerage/commission paid. Courtesy: Sentrix & JPM

Currency Strength Index: FxWirePro's hourly CAD spot index is flashing at -81 levels (which is highly bearish), hourly JPY spot index was at -99 (bearish) while articulating at (07:29 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed