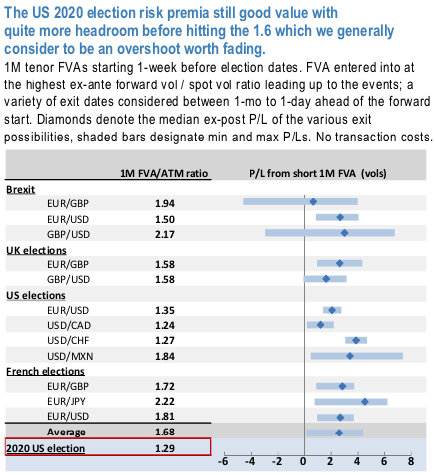

With an objective of assessing a rough fair value of election risk, we compare the current 2020 US election pricing with four recent election events and study the theoretical profitability of entering into FVA selling strategies conditioned on the peak ex-ante premium of forward volatility spanning the event over pre-event spot volatility (expressed as the ratio of forward vol/spot vol). FVAs considered are 1M in tenor with forward start date set 1-week before the event, which strike a decent compromise between isolating event risk and ensuring realistic pricing. A variety of trade exit timing possibilities between 1m to 1-day ahead of the FVA forward start date are explored.

The 1st figure (nutshell) summarizes the comparison and establishes a rough threshold for pricing of election risk. When 1M FVAs (containing election event) vs ATM pricing ratios exceeds 1.6X the election risk is getting overpriced. Thus, at 1.3X times, the current election fwd vol pricing of the US 2020 election is indicating still good value and quite more headroom.

Even after the September 10vol jump in overnights pricing of the US 2020 election all the way up to 35vols, USDJPY election vols strike us as still a good value considering the level of potential political noise and the corresponding election tail risks that await next year. 1Y/3M fwd vols in yen and yen crosses are an attractive low management and wide net (catch all) risk-off hedge that screen favorably on the screen in 2ndchart.

Arguably, the rolldown to the 1Y spot vol is less relevant as the 1Y options do not account for the Nov event risk yet. Yen fwd vols have been under pressure and the length of the yen positioning is likely to keep yen gamma in check near term but yen’s sensitivity to political risk (refer 1st chart), liquidity of yen options even as far out as 1Y1Y, flat vol curve and still very attractive pricing especially in the fwd vol space make it an appealing choice for hedging 2020 risks.

While the 3rd chart reinforces that notion. Even after the uptick amid emergence of the impeachment noise yen and x-yen 1y1y fwd vols remain near the multi-year lows.

We recommend 1y3m fwd vols for snug hedging of the US 2020 election risk and added sensitivity to the event risk: 1Y3M USDJPY FVA @8.35/8.85 indicative. Courtesy: JPM

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges