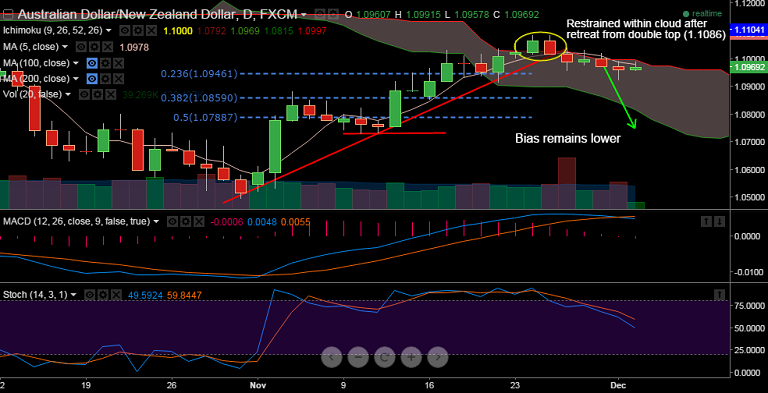

AUD/NZD price action ranges within the cloud, the pair has edged lower after hitting double tops at 1.1086 (24th and 25th Nov), daily Stochs have rolled over from overbought.

- The pair was only marginally higher after strong Australia GDP data, hit session highs at 1.0992, but was rejected at highs and is currently trading around 1.0967 levels

- Upside in the pair has been capped by 5 DMA (currently at 1.0978) since Nov 26th, long upper wicks on candles also highlights selling pressure on the upside

- Not much chart support seen on the downside. We are looking for retreats upto 1.0860 (38.2% Fibo of 1.0496-1.1086 rise)

Resistance Levels:

R1: 1.0978 (5 DMA)

R2: 1.0992 (Dec 1 highs)

R3: 1.1014 (Nov 18 highs)

Support Levels:

S1: 1.0946 ((23.6 % Fibo of 1.0496-1.1086 rise)

S2: 1.0924 (Dec 1 low)

S3: 1.0919 (21-Day MA)