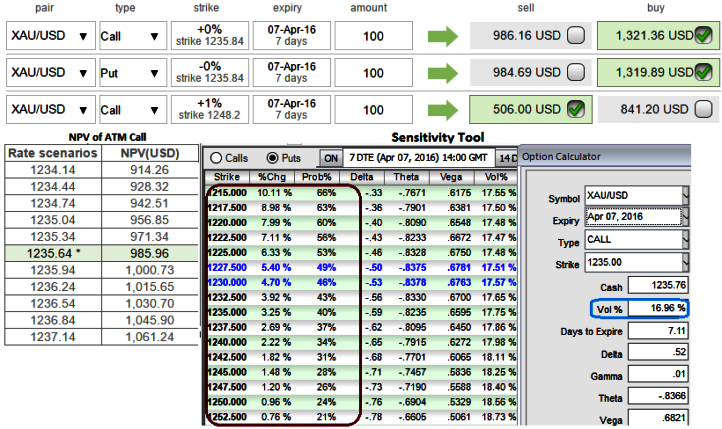

The ATM implied volatility of 1W XAU/USD contracts are just below 17%.

The premiums of 1W ATM contracts are trading at 34.11% more than Net Present Value of these instruments, hence, contemplating this disparity with neutral bullish risk reversal we think the opportunity lies in writing a call while formulating below hedging strategy for gold's short term uncertainty at this juncture.

Gold spot has been struggling to break and sustain above the resistance at 1245-50 levels (21DMA) from last couple of days, gold plummeted from the highs of 1284.41 to the current 1235.65 levels.

Gold for June delivery on the Comex division of the NYME shed $3.90, or 0.32%, to trade at $1,233.60 a troy ounce by 12:33GMT, or 8:33AM ET.

Hedging Framework:

Strategy: 3-Way Options straddle versus OTM Call

Spread ratio: (Long 1: Long 1: Short 1)

Time frame: Short term

Rationale: Firstly, overpriced premiums when compared with 1W ATM IVs hence there exists a considerable disparity between premiums and vols and technically the price oscillating between 1245-50 to 1220 from couple days, that keeps us eye on shorting such expensive calls with shorter expiries. As a result, we capitalize on such beneficial instruments and deploy in our strategy.

Secondly, we get a clue as to why do we have to choose OTM instruments for writing when glancing on sensitivity tool, OTM strikes are on the competitive edge.

How to execute:

Go long in XAU/USD 1W At the money delta put, Go long 1W at the money delta call and simultaneously, Short 1W(1%) out of the money call with positive theta.