Despite data beginning to show that the US economy’s outperformance is beginning to wane, the USD performed strongly overnight, sending kiwi back down through support.

We are not convinced this broad USD strength will persist, but for now it is in the box seat. Fed’s Powell Jackson Hole speech will be a key focus.

NZD faces domestic headwinds to local rates that are only now being fully appreciated. Growth has weakened, the central bank’s inflation forecasts have been revised materially lower, net immigration is slowing and business confidence has fallen significantly since the change of government.

Amid the lingering trade tensions between US-China that remain the market focus in the days to come, risks are to 0.65 by year end.

OTC Outlook and Options Strategy:

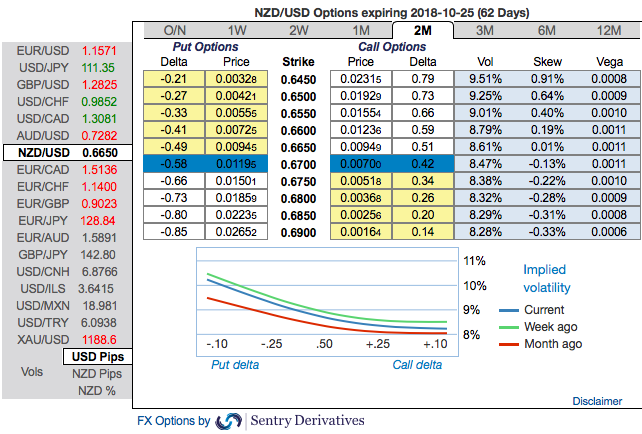

Most importantly, never disregard the signals of OTC market hedging sentiments, the positively skewed IVs of 2m tenors signify the hedgers’ interests for bearish risks. The bids have stretched for OTM put strikes upto 0.65 levels (above nutshell).

Accordingly, we advocate 2m (1%) in the money -0.79 delta put options, the rationale for choosing such derivative instrument is that the deep in the money call with a very strong delta would move in tandem with the underlying move. Deep in the money call with a very strong delta will move in tandem with the underlying.

Thereby, the above positions address both upswings that are prevailing in short run and bearish risks in long run by vega longs.

Currency Strength Index: FxWirePro's hourly NZD is inching at -138 (which is bearish), USD spot index is flashing at 81 levels (which is bullish), while articulating (at 08:44 GMT). For more details on the index, please refer below weblink:

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty