As we have done with the Brexit-driven long GBP vol theme the last year, NAFTA or BoC-related CAD-volatility seems to be the best isolated via easy-to-carry relative value structures in 2018.

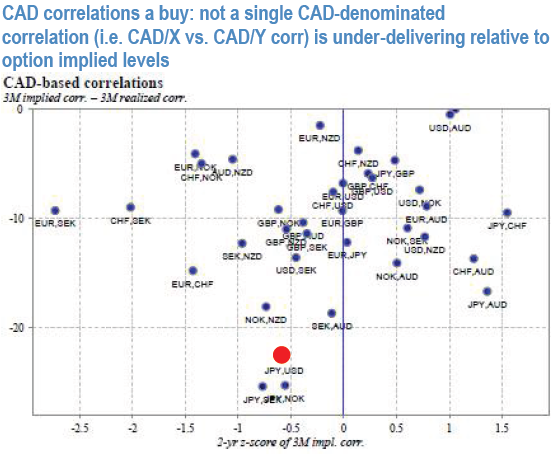

CAD-denominated correlations have been a rich seam of trades to mine in this regard, as implied correlation is not a single CAD/X vs CAD/Y pair is priced above trailing realizeds, and in the most cases actually trades steeply (refer 1st chart).

Among the relatively more liquid pairs, the most discounted CAD-corr of interest is CADUSD vs. CADJPY (3M implied corr. 51, realized corrs 1m 75, 3m 73).

Given the low-yielding / funding currency status of both USD and JPY, and CAD’s traditionally tight link to the global growth cycle that tends to exert similar directional influence on both pairs, above-average correlation is the norm rather than the exception for CADUSD and CADJPY; 2nd chart illustrates that a hypothetical strategy of systematically owning CADUSD vs CADJPY correlation swaps would have generated high Sharpe Ratio returns (excluding transaction costs, hence hypothetical) over a long history spanning multiple volatility cycles.

Selectively long FX volatility

A systematic short vol strategy delivered impressive returns this year. But value exhaustion is the main threat to a continued bear trend in vol: the VXY FX vol index is

1) In the bottom decile of the past 25 years,

2) 4-ppts lower than at the start of 2017, and

3) 1.5-ppts cheap compared to traditional macro drivers. Set against this, the fundamental case for owning GBP volatility is straightforward and coloured by uncertainty on multiple fronts – around the Brexit process, increasingly dysfunctional domestic politics, continued debate around the abrupt change in the BoE’s reaction function and the risk of an unwind of the 100bp of rate hikes priced along the yield curve should growth and/or politics intercede.

Yet current levels of implied vols are below pre-referendum levels from last year and below realized vol from the trading range of the past 3-6 months.

Depressed volatility is keeping entry costs low while uncertainty increases the probability of a positive return. Japan and core Eurozone are our preferred markets. But the high-speed sector rotation is making the choice and the timing crucial.

Ultimately, a transaction-cost friendly version of the full correlation triangle is to buy CADJPY – USDJPY vol spreads that are historically low (6M ATM spread 0.9 vs. 3-yr avg. 1.6), offers marginal (0.5 vol pts.) RV edge vs. the corr swap to go with greater liquidity, insulation to any idiosyncratic yen volatility stemming from an earlier/larger-than-expected re-set of the BoJ’s 10YY JGB yield target, and is similar in spirit to the GBPJPY – USDJPY vol spread we bought in 2018 to hedge against any Brexit-related upheaval in the pound. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist