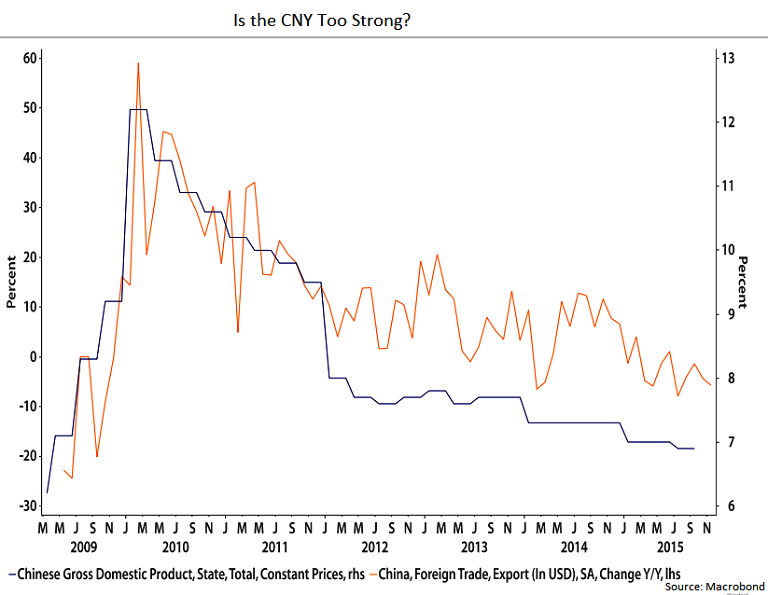

Amidst continuing concerns regarding slowing growth and weak price pressures in China, PBoC continues to guide the yuan lower vs. the USD. However, the PBoC will be keen to control the pace of addition falls in the value of the CNY potentially for fear of spooking investor confidence. The yuan is expected to weaken vs. the USD during the course of 2016 and a weaker CNY could have significant implications for China's trading partners.

If China is successful in weakening the yuan, then the central banks of its trading partners could be forced into taking retaliating action, implying that the easing cycle of many central banks is a long way from being over. Even the Fed could even be forced to rein back the pace of its rate cuts in order to prevent the value of the USD rising too rapidly on the back of this new phase of currency wars.

Amidst the global currency wars in recent years, two major central banks that have been both players and winners - the BoJ and the ECB. The BoJ at its last meet on Friday made no changes to its existing QQE policy target, but it did alter the composition of its asset purchases. CNY/JPY gains in 2013 and 2014 have been instrumental in keeping down the value of Japan's effective exchange rate. However, devaluation of the CNY put paid to the CNY/JPY uptrend of recent years. BoJ Governor Kuroda indicated little desire to ease policy further but any tightening in Japanese monetary conditions as a result in a rise in JPY/CNY may make the BoJ more responsive to further easing.

Similar logic can be applied with regards to the ECB and to other central banks of countries that export heavily to China such as the RBA and the RBNZ. Any extension in the Eurozone easing cycle will trigger reaction in central banks such as the BoE, Riksbank and SNB which will be watching the value of the EUR closely. That said, further weakening in the value of the CNY is likely to have a major impact on the commodity based countries.

In Australia, despite resilience in the labour market, new jobs are failing to significantly boost wage inflation, thereby raising uncertainty about the prospect of further RBA easing. Weakness of coal and iron ore prices will also manifest in weaker incomes and the risk of any gains in AUD/CNY will enhance the risk of further RBA easing. On Dec 10th, the Reserve Bank of New Zealand cut the official cash rate for the fourth time in seven months and said that it was still not comfortable with the exchange rate at this level and there is room for further cuts if the need arises.

China's yuan edged up against the dollar on Monday after PBoC set stronger guidance via its daily midpoint, snapping 10 weaker fixes in a row. The Central Bank set the yuan/dollar midpoint rate at 6.4753 per dollar prior to market open, 0.09 percent firmer than the previous fix 6.4814. The spot market opened at 6.4771 per dollar and was trading at 6.4874 as of 1130 GMT.

Further weakening of CNY in 2016 could prolong easing cycles of other central banks

Monday, December 21, 2015 11:53 AM UTC

Editor's Picks

- Market Data

Most Popular

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices