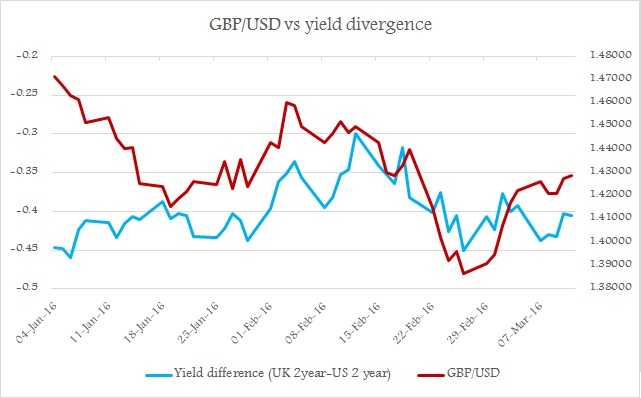

In the past, Pound/Dollar has shown closer affinity to yield divergence, however its relationship hasn't hold always against US Dollar since it is not a traditional funding currency. Nevertheless, relationship with 2 year yield spread reveals a lot.

Graph representing movement shows, throughout February and a few days more this relationship has held well, however early January data shows, Pound has dropped sharply despite rise in yield difference in favor of gilts.

It can be somewhat inferred Pound has largely suffered from risk aversion but it also reveals mild risk aversion isn't a major mover.

Going forward we expect the yield gap is certain to provide guidance over the pair, but relations to suffer from investors pricing risks of Britain's exit from European Union and in cases of China led massive risk aversion.

Pound is currently trading at 1.429 against Dollar.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed