In this series, like we said before we will be reviewing the fundamental factors that influence currency movement in short, medium and longer term.

One of such key fundamental is short term yield divergence, which influences currency movement via carry trade positions. History has shown, short term yield such as gap between 2 year treasury and European benchmark German bund go hand in hand with EUR/USD.

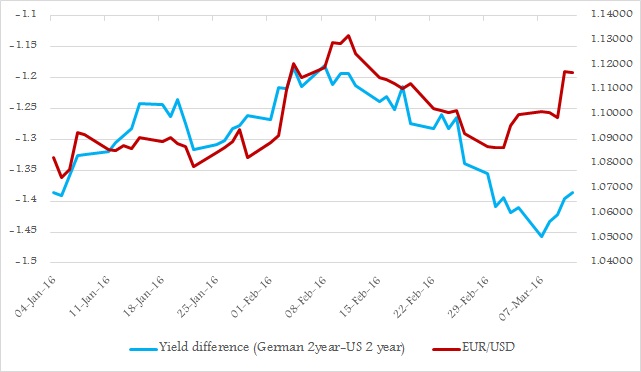

While yesterday's Euro's move might have surprised many of us, the above chart will surprise you more.

It is clear throughout 2016, Euro/Dollar has moved in line with yield gap but surprisingly this relationship has diverged quite significantly in recent times, from March to be specific.

Yield difference between US and German 2 year yield has continued to decline EUR/USD has moved up. So naturally Euro found more of a push, when yield narrowed after policy announcement.

If yield difference failing to keep Euro down against Dollar, it was probably of less surprising that Euro went up yesterday.

It is highly recommended to keep a close watch over this relationship. If Euro can diverge from the difference, further narrowing of yield gap likely to push higher.

Euro is currently trading at 1.112 against Dollar.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed