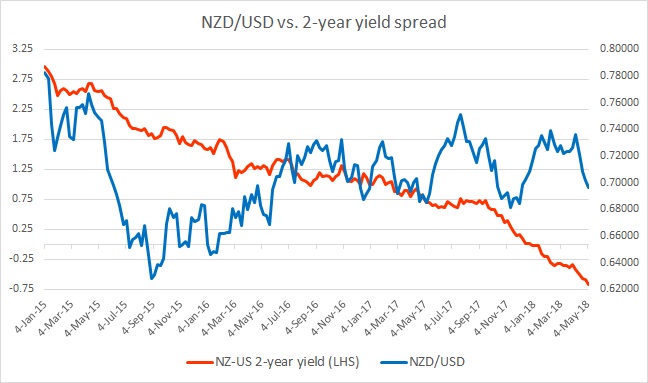

The chart above shows, how the relationship between NZD/USD and 2-year yield divergence has unfolded since 2015.

Brief background:

- The close relations between the short-term yield spread and the exchange rate is quite visible also the big divergence with it.

- While the Reserve Bank of New Zealand (RBNZ) reduced rates after the financial crisis of 2008/09, it somewhat increased interest rates due to higher commodity prices and higher inflows from other western economies. It raised rates by 50 basis points to 3 percent in 2010, only to reduce it again to 2.5 percent in early 2011. In 2014, it increased rates by 1 percent to 3.5 percent and started reducing rates again beginning June 2015. The rates steadily declined from 3.5 percent to 1.75 percent by November 2016, when it signaled a halt.

- It can be seen from the chart that New Zealand dollar declined from 0.78 against the dollar in January 2015 to 0.62 by August, while the yield spread declined from 296 basis points to 192 basis points.

- However, there has been divergence since then. Between now and the August 2015, the RBNZ reduced rates further by 100 basis points, while Fed raised rates by 100 basis points. The yield spread also declined from 190 basis points to just 76 basis points. However, the NZD/USD didn’t make further low, instead, it has moved higher from 0.628 in August 2015 to 0.75 in July making the divergence quite large.

Past Reviews:

- In one of our previous reviews, we noted that the divergence could be result of expectations of a rebound in commodities as well as New Zealand economy but warned our readers that sooner or letter the du0 would have to converge, which we expect would come in terms of rate hikes from RBNZ and increase in the spread in favor of the New Zealand dollar.

- In our last review in October, we noted that as expected, in absence of hawkish rhetoric from the RBNZ, the New Zealand dollar has declined sharply, thus reducing the divergence.

- By early October, the yield spread (NZ-US) declined further by 12 bps to 62 bps and the New Zealand dollar weakened by 340 pips to 0.717 against the USD, thus reducing the divergence.

- In our early November review, we noted that the yield spread has further declined from 62 bps to 38 bps as of and the New Zealand dollar declined by another 160 pips to 0.694 against the USD.

- In our next review, we noted that the spread has declined by 15 bps to 23 bps in favor of the dollar, while the exchange rate declined by just 20 pips to 0.688.

- In the mid-December review, we noted that the spread has declined from 23 basis points to 4 basis points, while kiwi has strengthened by 120 pips to 0.7 against the dollar; thus widening the already large divergence.

- In our January review, we noted that the spread has further declined from 4 basis points to -13 bps favoring the dollar, however, the kiwi dollar has strengthened by almost 365 pips and currently trading at 0.736 against the dollar.

- In our February review, we noted that the spread has further widened by 24 bps to -39 bps in favor of the dollar and the kiwi has only declined by 10 pips to 0.735 against the USD.

- In our last review in April, we noted the spread hasn’t changed much from February as it trades at -39 bps, while Kiwi rose by 30 pips to 0.738 against the USD.

Current status:

Since that review, the spread widened sharply in favor of the dollar by 28 bps to -67 bps and the New Zealand dollar responded accordingly by declining 410 pips and currently trading at 0.697 against the dollar.

The divergence visible in that chart is still quite large.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

RBA Reassesses Pricing Behaviors and Policy Impact Amid Inflation Pressures

RBA Reassesses Pricing Behaviors and Policy Impact Amid Inflation Pressures  BOJ Governor Ueda and PM Takaichi Set for Key Meeting Amid Yen Slide and Rate-Hike Debate

BOJ Governor Ueda and PM Takaichi Set for Key Meeting Amid Yen Slide and Rate-Hike Debate  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  RBI Cuts Repo Rate to 5.25% as Inflation Cools and Growth Outlook Strengthens

RBI Cuts Repo Rate to 5.25% as Inflation Cools and Growth Outlook Strengthens  RBNZ Cuts Interest Rates Again as Inflation Cools and Recovery Remains Fragile

RBNZ Cuts Interest Rates Again as Inflation Cools and Recovery Remains Fragile